Main update

Been trying to embrace this principle lately:

Macro

This sums up the current macro climate:

Things still look bad in May but cracks are beginning to emerge, showing signs that the market may have priced in peak tightening.

Two possible paths lay in front of us:

A sharp recession and rebound,

A bigger recession and extended bear market for risk assets, particularly crypto.

Which path eventuates depends on the persistence of high food/energy prices (leading to unhappy voters) and how hard S&P500 continues to fight the Fed (affecting wealth effect). The lower the CPI/PCE, the lower the S&P and Nasdaq, the more likely that the Fed will ease off on further tightening liquidity.

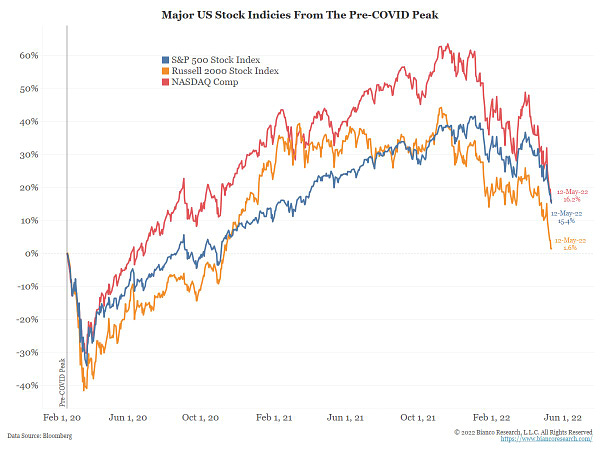

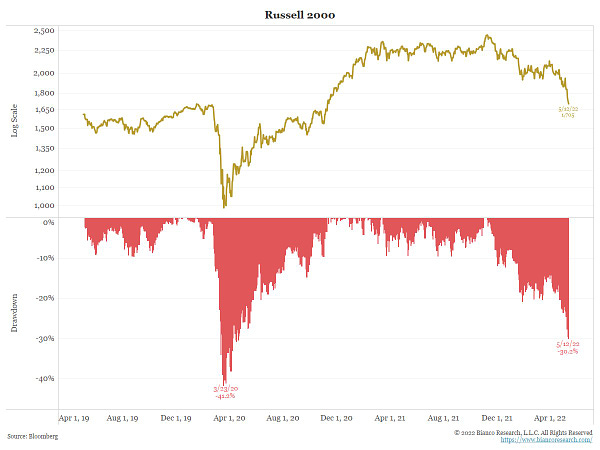

The good news is that YTD, we have already seen a historic level of financial asset wealth destruction, and recessionary signals are beginning to emerge from forward looking data.

The bad news is that CPI is still high and the Fed cannot influence the supply side of the equation (thanks Putin) via monetary policy, so it must destroy demand.

Event: Powell has lunch with Biden.

Real event: Ffs Powell Wow, bring inflation down or you and I are both gonna be out of jobs come November election.

A third (more remote) possibility is that as rates rise and liquidity tightens, something structurally breaks in the credit or bond market, forcing the Fed to conduct emergency operations. Anything goes under this scenario, but I will likely be a buyer into this.

See 1 Macro update below for more details.

Crypto

The collapse of LUNA (beginning 9 May 2022) will be remembered as a historic day in crypto, with ~$60B wiped from LUNA and UST market cap alone, before even considering the trickle-down effects. It likely set the industry back by months, lowered this cycle’s bottom for BTC and ETH and poured acid on the open flesh wounds of altcoins.

It did catastrophic damage to the broader crypto market, at a time when the crypto market was already experiencing pain from underlying macro conditions. What now? Prevailing consensus: be in no rush to time bottom on ALTS. Bide your time, don’t rush on re-entry.

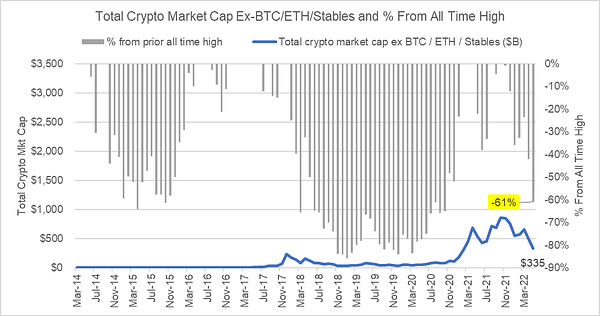

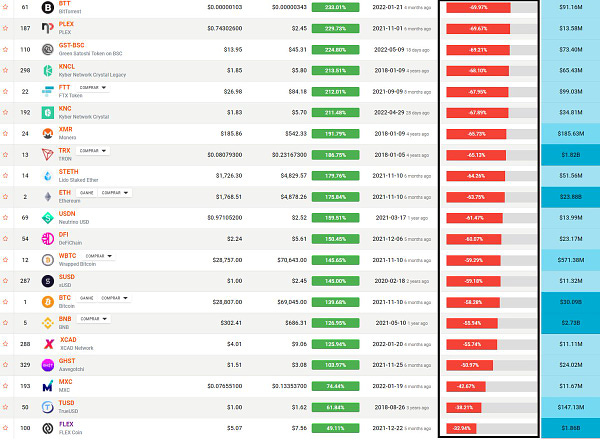

Bear market continues. Only 20 odd projects are down less than 70%…

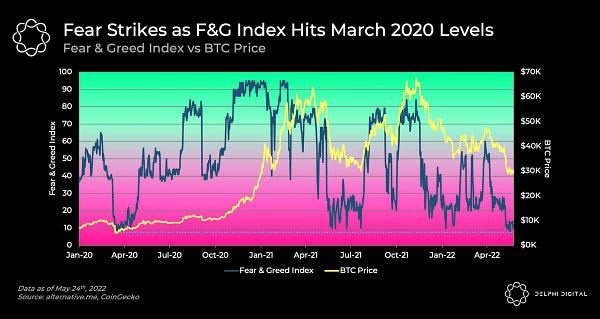

…while sentiment has hit all time low…

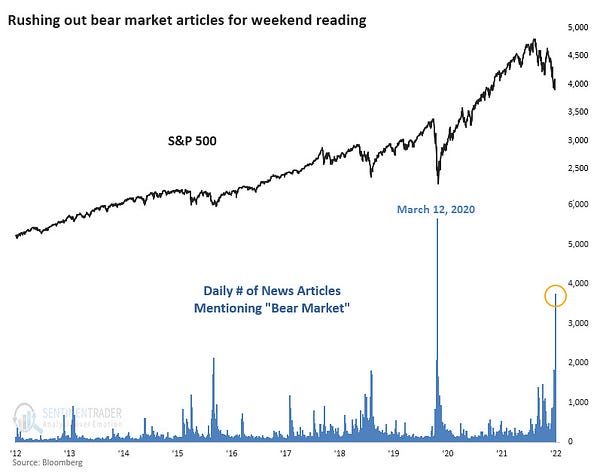

…and FUD at all time high.

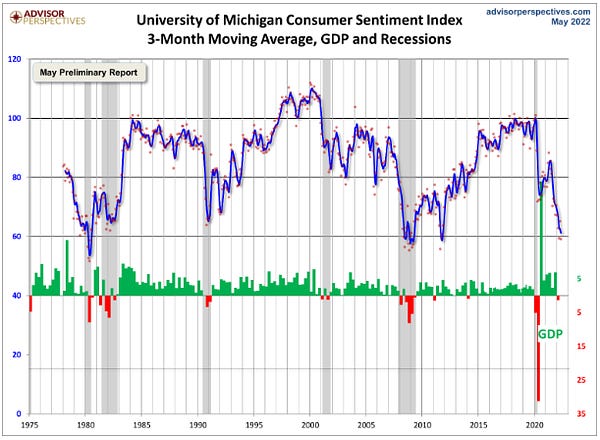

Consumer confidence is at its lowest in 10 years, currently sitting at historical recessionary levels.

The structural differences between equities and crypto also needs to be kept in mind, especially before you deploy more capital into ALTS.

Directionally, consensus appears to be this cycle’s low is NOT in, despite touching local low of 25k BTC and 1.7k ETH in May.

Meanwhile, BTC has also decoupled from the broader crypto market, with BTC.D rising 5% since 11 May 2022, now sitting at 46.8%. Break above 48-49% could signal more pain for ALTs.

All of this makes me bullish. It makes me think that generational wealth creation opportunities are emerging. So I intend to keep one eye on macro environment, and the other keenly on opportunities to accumulate my favorite coins at bargain prices.

Specific trends and opportunities

Here are the specific rabbit holes I went down in May:

Macro update

Bitcoin

Ethereum

Stablecoin

State of VC

Defi

Infrastructure

Other

1 Macro update

April 2022 YoY CPI came in at 8.3%, slightly down from a decade-high of 8.5% in March. In order to reach 3-4% CPI by end of 2022, CPI needs to fall by 0.5-0.66% per month from May to Dec 2022. This is the key economic indicator to watch, as CPI falling to 3-4% level will give room for the Fed to ease off its policy.

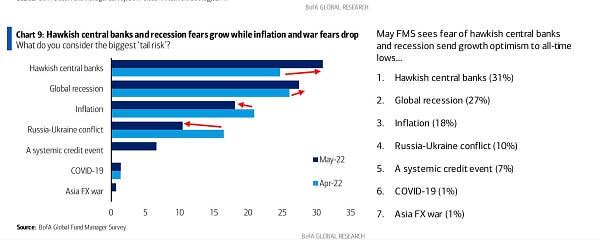

‘Hawkish’ central bank and ‘global recession’ is now top of mind for fund managers, ahead of inflation and war in Ukraine. It seems that how central banks will react to backward looking inflation data is now an equally important issue as actual inflation.

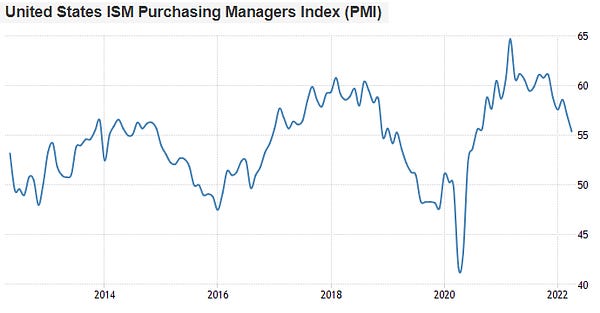

Now that the market may be pricing in peak Fed tightening, we are beginning to see some cracks in dollar strength.

Bond yields are also showing signs of slowdown, with US10Y trading as high as 3.20% on 9 May, now down to 2.87%. Not a fall to 1.85% (-135bps) on average has historically marked the macro bottom for S&P 500.

Small-cap equities has basically done a full retrace to pre-Covid levels (Feb 2020).

A lot of “wealth” has already been destroyed through the recent price action, with some effects undoubtedly trickling down to consumers behavior and sentiment.

Raoul shares his framework for assessing whether we get:

a sharp recession and rebound, or

a bigger recession and extended bear market for growth assets.

Raoul’s base case leans towards the former, being a buyer of tech over June and significant buyer of crypto into further weakness.

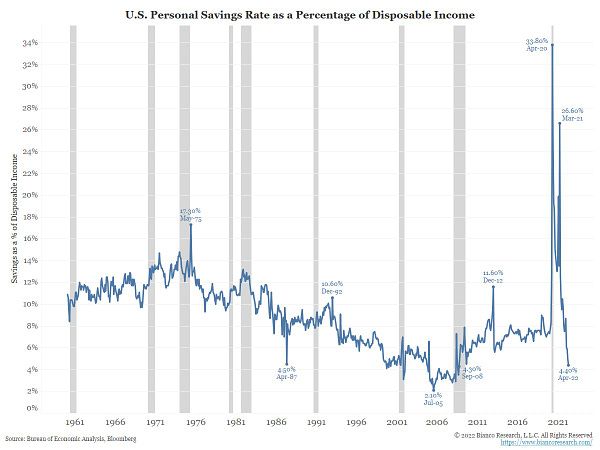

Jim reminds us that there is less disposable income for speculation as people tighten their belts given higher prices for everyday goods.

Zoltan on the Fed’s singular mission to slay inflation (14 May)

Our aim today is to highlight the risk that we might be dealing with a Fed that won’t be intimidated by curve inversions and asset price corrections, but will be emboldened by them to do more – a Fed that pushes against a curve inversion by hiking more than what’s priced today to tighten financial conditions further, despite recession risks or perhaps even with a (covert) recession goal in mind in order to maintain price stability.

Looking back, QE was essentially monetary policy for the asset rich, with trickle-down benefits for the less wealthy

If the origin of QE is to lean against deflation by generating asset price inflation (positive wealth effects), leaning against inflation must involve generating asset price deflation (negative wealth effects)

the Fed has a singular mission, which is slaying inflation

price stability, full employment, and financial stability are not possible to achieve all at the same time. Something has to give. The Fed appears to have chosen price stability as the priority

Non-existent liquidity in Eurodollar futures is exacerbating moves in rates markets. The market does not know what to price – have we priced in the peak for fed funds yet, or is the peak at 4% or 5%? This uncertainty is feeding volatility and a sell-off in equities and crypto assets.

We have never achieved a soft landing, so let’s not pretend that the fastest pace of hikes in a generation and an unprecedented shrinkage of the balance sheet will yield one.

2 BTC

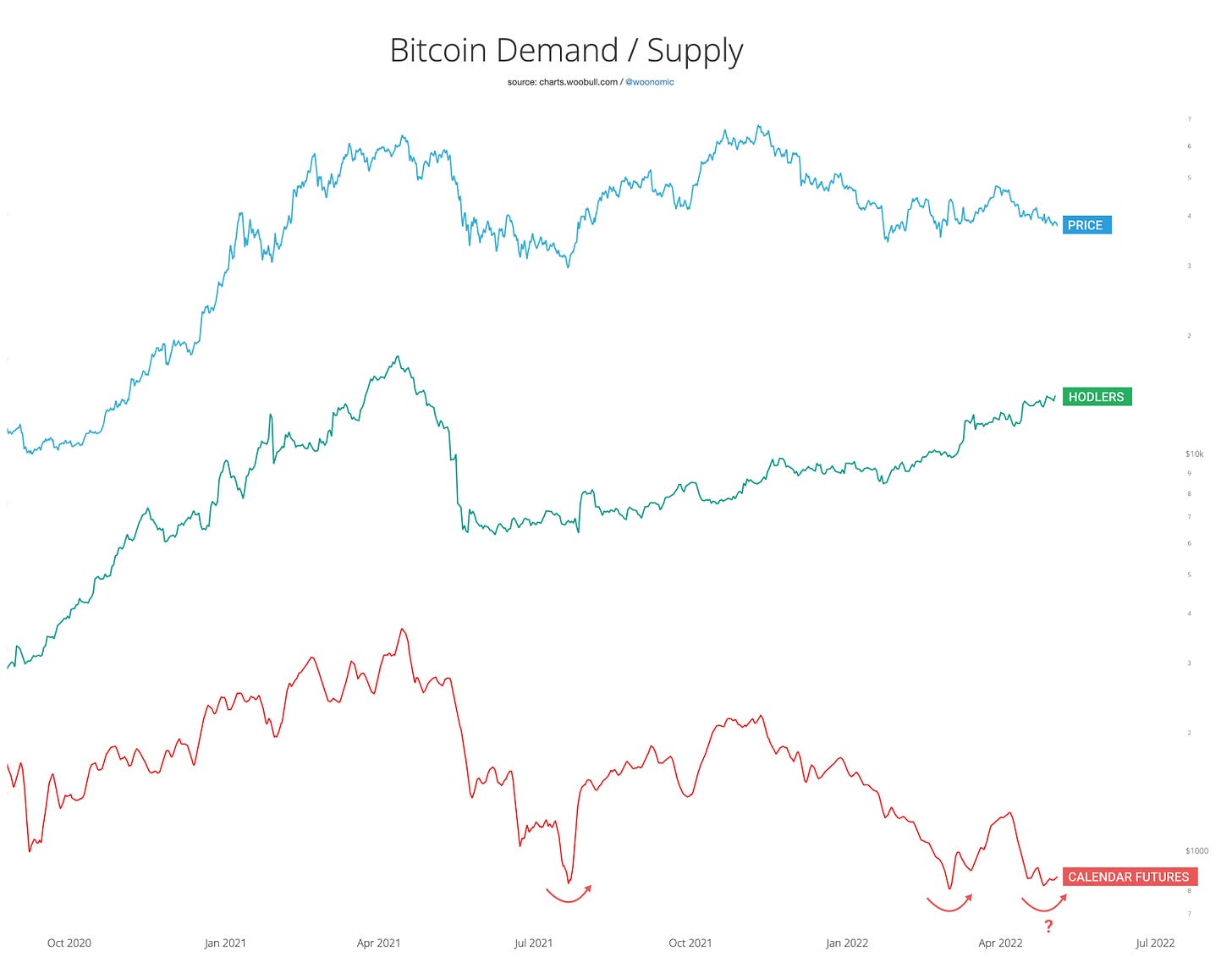

Willy Woo #forecast 061: The last letter (5 May)

Willy Woo bitcoin forecast has come to an end, he’s going on a holiday with his family. Here are Willy’s final observations (note this email was sent before LUNA collapsed):

spot demand (especially LT holders) is strong (nearing multi-year highs), with coins moving off exchanges at record pace

but futures dictates short term price atm

strong correlation with equities could mean another leg down

futures funding rates at historical minimum + low volatility in bitcoin price typically suggests large price movements to come

forecast: bottom forming with sideways price action giving way to bullish price rally in coming weeks

long term outlook: market is in extended accumulation band, on-chain supply shock continues to strengthen, strong buying unreflected in price, typically ends in large bullish price squeeze

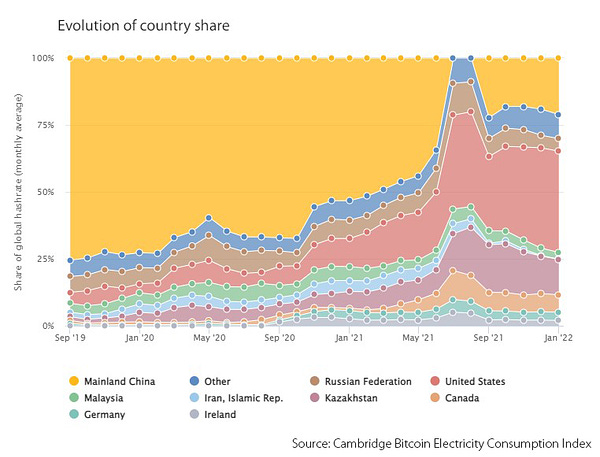

It seems there is a resurgence of ‘underground’ BTC mining in China.

Don’t fade Stablecoin on Lightning

David Marcus announced that he co-founded a new company called Lightspark, aimed at building on the Bitcoin-based Lightning network. An undisclosed amount of funding was raised from a16z and Paradigm. Marcus was formerly president of PayPal, until he left the company and joined Facebook in 2014. At Facebook, he was the vice president of their messaging products group, and then went on to lead their internal blockchain group, which eventually morphed into Diem/Novi.

Here’s what Lyn Alden had to say:

In my opinion, it speaks volumes that an executive who spent years trying to deploy stablecoins for payments at Facebook, is moving over to the Bitcoin/Lightning ecosystem with major funding. And keep in mind that with the upcoming launch of the Taro protocol, we’ll likely see native stablecoins on Lightning.

3 ETH

A summary of all the common reasons why people buy ETH over BTC.

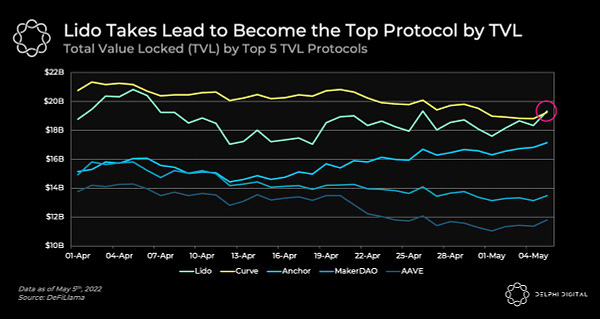

Lido continues to dominate the liquid staking game, now holding 32% of all ETH staked in ETH2.0 deposit contract.

This article was widely shared (including by Vitalik) and even if you don’t care for the specifics, the key takeaways are useful to understand. My notes:

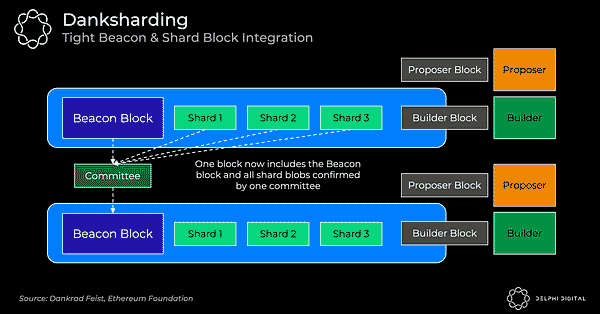

Everything ultimately weaves into one overarching goal – scale computation without sacrificing decentralized validation

All roads lead to centralized block production, decentralized trustless block validation, and censorship resistance

Specialized actors will build blocks for both the L1 and above. Ethereum remains incredibly secure through easy decentralized validation, and rollups inherit their security from the L1. Ethereum then provides settlement and data availability allowing rollups to scale.

4 Stablecoin

The collapse of LUNA has been covered ad nauseum, so I will keep it brief. Here is the best post-mortem that I’ve come across.

Zooming out, this is a good primer on stablecoin design as they stand today:

Arthur Hayes discussed the optimal stablecoin design at length following the collapse of LUNA. In his article, he laid out 4 design options and explained why a Bitcoin and derivatives-backed stablecoin is most preferable. Interestingly, this exact model has already been implemented by UXD Protocol on Solana, albeit UXD draws from Solana DEX liquidity (e.g. Mango) rather than CEX (e.g. Binance).

Explainer of USN and potential sources of yield for USN holders. Note current APY on Ref Finance for USN-USDT pool is 11.5%.

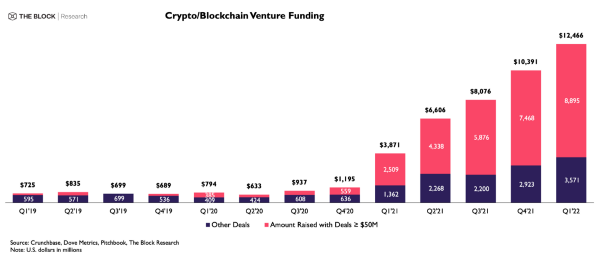

5 State of VC

This is why crypto VC funds almost exclusively invests in private market, and avoid liquid and secondary market:

Summary of VC state of funding as of Q1 2022, a record hot quarter. We can expect to see reduced activity from Q2 2022 onwards:

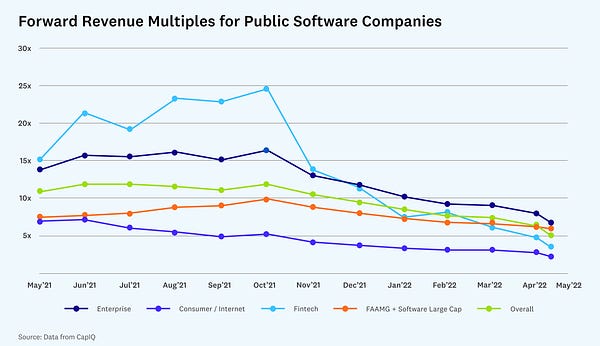

SaaS multiples has done a round trip, now below pre-Covid means, a reflection of what rising rates can do to risk assets. Investing is all about rates, as eloquently articulated by Brad Gerstner in this talk.

6 Defi

Dopex (DPX / rDPX)

The team at Dopex continues to ship and gives no fucks about bears.

Interest rate option (IRO) vaults was launched in May, allowing purchasers to hedge and/or speculate on APY of specified Curve pools. On the other side, option writers can deposit Curve 2pool LP tokens into an IRO vault to earn premium and rewards.

Separately, the token economic and value accrual design for rDPX (Dopex’s rebate token) was completely re-worked in March to tie in with the launch of dpxUSD in the future. It’s pretty giga-brain stuff but I found the following explainers helpful.

I like the Dopex team, its community and the addressable market (defi options), but am in no rush to accumulate DPX and rDPX given the current climate.

7 Infrastructure

GenesysGo (SHDW) launched Shadow Drive, bringing decentralized storage to Solana.

8 Other

Quick primer on Merit Circle ($MC), one of my ALT investments.

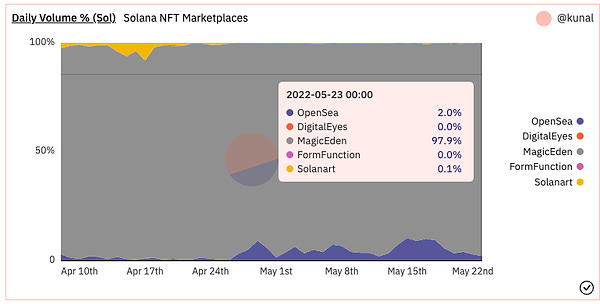

Magic Eden has retained its dominant market share (>90% by daily volume) since OpenSea launched on Solana. This suggest that network effects could be community specific, not global.

The team at UXD on how to think about circulating market cap vs. FDV. My notes:

inflation schedule is far more important FDV

FDV is much less important than the probability that such tokens are ever issued

FDV/float represents the “degree of tightness” of the handcuffs on the team/DAO. If this ratio is 1, then there is no trust assumption, but also no flexibility. If the ratio is large, there is a massive trust assumption, but also tons of flexibility. The right answer is probably somewhere in between.

Aptos Labs (another layer 1) secures $200m in funding

Safest and most scalable Layer 1 blockchain, led by Mo Shaikh and Avery Ching, lead builders who worked on Libra/Diem and Calibra/Novi at Meta. Mature technology with Aptos testnet launched 15 Mar 2022, and targeting mainnet in Q3 2022. Focused on scaling single-shard performance.

Crypto is powerful because it is both a new type of distributed computer for developers - blockchains, and also the conduit for an entirely new asset class to be created - tokens

Portfolio allocation update

Target allocation update

Cash allocation reduced to 19% from 38% to reflect the fact that prices for assets I want to accumulate are approaching ‘DCA in / buy on capitulation’ zones

Infrastructure allocation reduced from 12% to 8% to reflect significant drawdown in asset price performance of POKT and STG and the fact that I will not be adding to those positions

Smart contract L1 allocation increased from 11% to 33%, given this space still offers best risk-reward for current climate. ETH allocation increased to 20%, with the rest allocated to SOL, AVAX and NEAR

BTC allocation increased to 7% from 5%

New

Claimed OP airdrop and sold to ETH

Existing

added to BTC, ETH, SOL, AVAX, NEAR, DPX, GMX, FXS, SHDW, with most of the capital deployed into ETH

Exits

exited portion of LFNTY at double the entry price ($0.84) to derisk, returning 67% of original investment

Overall, I deployed 10% of portfolio into the chaos that was the LUNA induced sell off, while acknowledging that this may not be this cycle’s bottom. Most happy with picking up some BTC/ETH at 25.5k/1.7k levels and how well Bitcoin held up.

Contact me

Twitter: EtherKai @btc21m

Email: kai.btc21m@gmail.com

About Kai

Bought the 2017 top, fell down the crypto rabbit hole in 2020, full-time Magical Internet Money HODLer & user since.

Prior: a decade in TradFi (renewables/investment banking/capital markets).

Thank you

@cobie @Pentosh1 @CryptoHayes @zhusu @hasufl @Arthur_0x @FedGuy12 @KyleSamani @mrjasonchoi @woonomic @Rewkang @LynAldenContact @RaoulGMI @DegenSpartan @richwgalvin @finematics @santiagoroel @nic_carter @panicselling @EPBResearch @SBF_FTX @Delphi_Digital @biancoresearch

Disclaimer

This memo is presented for informational and entertainment purposes only and does not constitute financial advice. Individuals have unique circumstances, goals and risk tolerances, so please do your own research before making investment decisions.

So bearish, I'm bullish.