It’s times like this, when most people have all but left the space, that the seeds are sowed for generational wealth to be created. I encourage you to continue to pay attention, level up on your game, survive and most importantly, look after your physical and mental health. Personally, I found it easier to remain engaged in the space when the going was good. You naturally feel euphoric when you wake up to more paper wealth each day. Currently, there are some days when I don’t feel like keeping up with crypto at all, and that’s OK. I allow myself the privilege to rest. The rest is what allows me to not only remain in the game, but play the game long-term. To improve my mental health, my wife and I have moved to a 100 acre farm for the entire month of May. When I’m away from the screen, I run around and explore the farm with my dog. We invite friends over on the weekend, put on a movie and toast some marshmallow over a fire. So don’t be discouraged by the down or sideways only market, this is an opportunity, you just have to find your own way to stay in the game. Peace and love, my friend.

Portfolio allocation update

New positions

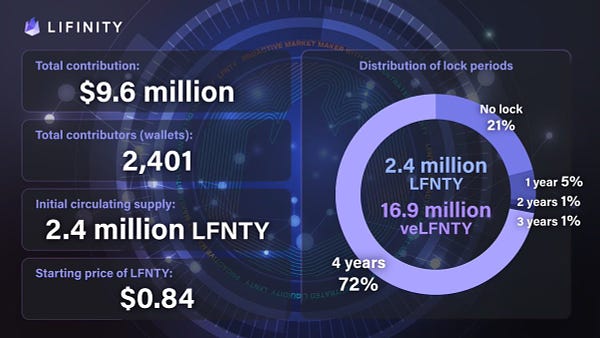

added 3% position to LFNTY (Defi) at $0.42 via Lifinity veIDO

added 1% position to $STG (Infrastructure) at $0.25 via Stargate auction

Existing positions

added to $SBR (Defi) at $0.022

added to $GMX (Defi) at $28

changed weekly DCA to 75% ETH / 25% BTC from 100% BTC

Exits

sold 35% of $SHDW (Infrastructure) at $1.83 to derisk, when price +100% in a week, look to buy back lower

fully exited $DPX (Defi) at $1,853 on pump to de-risk, look to buy back lower

fully exited $RNDR (Infrastructure) at $2.93 given lack of interest and conviction in digital rendering

Main update

Macro

Macro conditions continue to deteriorate:

DXY broke >100 last week, signaling risk off

US10Y is at 2.94% (recall from last issue that >2.5% = macro regime change)

US10Y-US02Y hovers at 20 bps, signaling weakening economic conditions

Eurodollar Mar 2023 futures contract is pricing in 13 hikes, implying a rate of 3.50% (or 2.25% higher vs. 4 months ago)

Meanwhile, quantitative tightening (QT) is expected to commence in May 2022, further tightening market liquidity (see 1 Macro update for details).

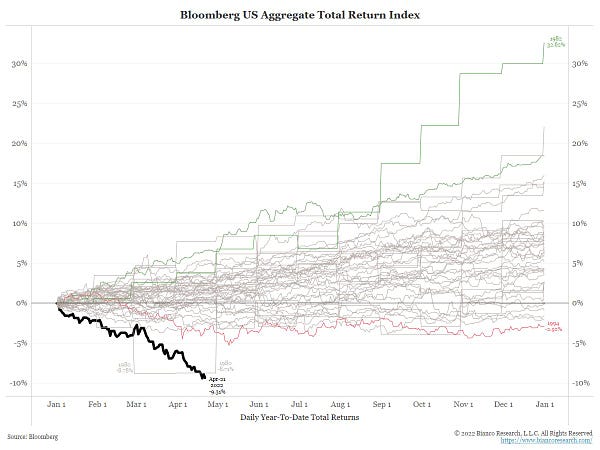

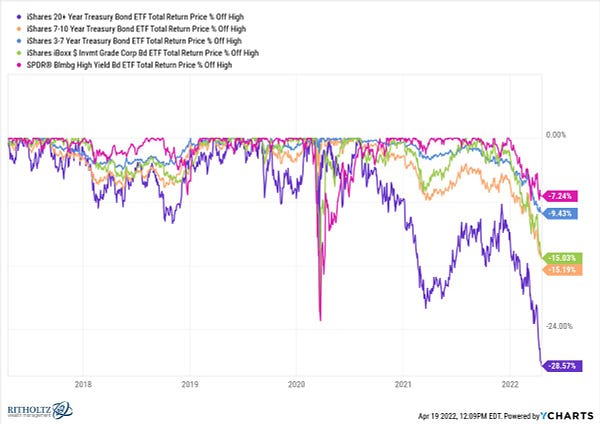

“Biblical” might be the right word to describe the current drawdown in the fixed income markets (see 1 Macro update). Bond indices have never suffered a loss this bad based on data dating back to mid 1970s.

This chart that supports this statement. It is the total return of the former Lehman, then Barclays, and now Bloomberg US domestic Aggregate Index. It goes back to the mid 1970s and the bond market's losses have never been this bad. Not even 1979, 1980 and 1981 (monthly calc)

This chart that supports this statement. It is the total return of the former Lehman, then Barclays, and now Bloomberg US domestic Aggregate Index. It goes back to the mid 1970s and the bond market's losses have never been this bad. Not even 1979, 1980 and 1981 (monthly calc) https://t.co/byCRgGrRwQ "This is the worst bond market in the history of statistics" @biancoresearch

https://t.co/byCRgGrRwQ "This is the worst bond market in the history of statistics" @biancoresearch 01123581321345589144233377610987159725844181 @1GazaDon

01123581321345589144233377610987159725844181 @1GazaDonEquity is finally beginning to remember the motto, “don’t fight the Fed.” S&P500 is down 13% while Nasdaq is down 27% YTD.

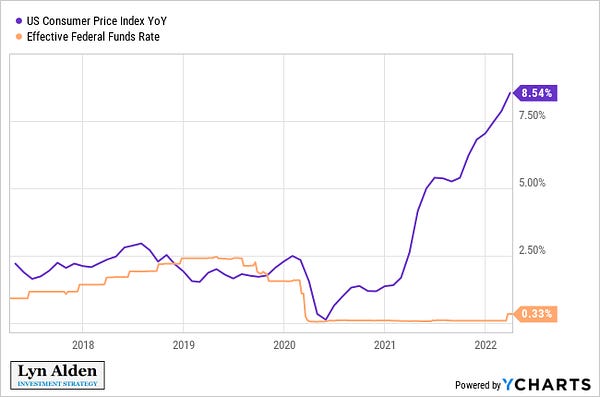

US registered its highest CPI print in 4 decades. Inflation remains the top issue affecting economic growth and outlook. It is also the most politically sensitive issue, more front of mind for people than climate change or the war in Ukraine. This makes sense since you’re messing with people’s cost of living, during a time when the wealth gap between the rich and poor is increasing.

Transition to Bretton Woods III is most important emerging trend to watch, catalyzed by the freezing of Russia’s foreign reserve assets, as Zoltan Poszar explains. As fiat currency is a system built on trust, we cannot write off $400 billion of Russia's foreign reserve assets without consequences. The move could catalyze secular inflation for the 2020s decade and a complete rethink of foreign reserve management for nations.

What is "Bretton Woods III" and are we witnessing the birth of a new world monetary order? Let's dig into what the best financial podcast this week is saying h/t @LynAldenContact for the recommendationThis was the best financial podcast of the week imo: https://t.co/dfuyZLvZCa

What is "Bretton Woods III" and are we witnessing the birth of a new world monetary order? Let's dig into what the best financial podcast this week is saying h/t @LynAldenContact for the recommendationThis was the best financial podcast of the week imo: https://t.co/dfuyZLvZCa Lyn Alden @LynAldenContact

Lyn Alden @LynAldenContactOverall, with US economic growth slowing, Europe facing energy security problems, and central banks tightening monetary policies into economic sluggishness, this remains a risk-off period.

Crypto

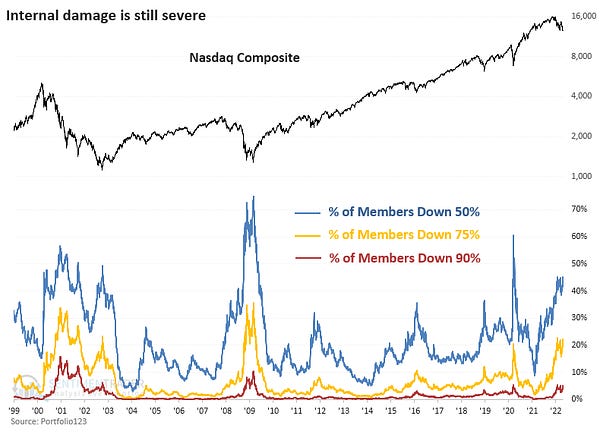

BTC is down 16% in last 30d, down 44% from ATH.

ETH is down 18% in last 30d, down 42% from ATH, with ETHBTC at the same level as start of 2022.

Most ALTS are down much more than that. In hindsight, I should’ve just sold everything, sat on cash and bought back my favourite projects at lower prices.

I see 4pool as the most important development in crypto this month (see 5 Stablecoin)

Value is beginning to emerge as most participants who didn’t sell are either down bad and/or have stopped paying attention altogether. Valuations on some tokens are reverting to zones where I’d be interested in buying. However, I continue to believe patience will be handsomely rewarded in 2022.

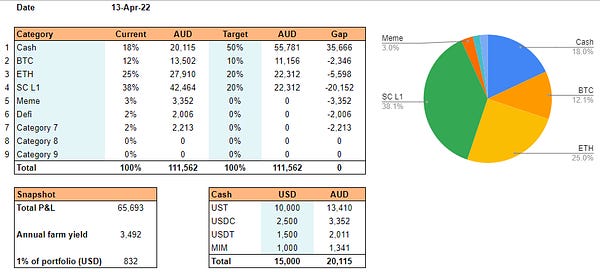

My Portfolio Tracker

Until now, I haven’t seen anyone share a robust system for tracking investments and yield farms, so I decided to share my own.

The below thread details my personal system for staying on top of 20 investments, 15 yield farms and 700+ trades over the years. I have refined this system over time specifically for crypto investing.

Here’s my promise to you: If you’re willing to put in some work, you’ll walk away with enough knowledge and confidence to build your own system that is simple to update and easy to use.

Specific trends and opportunities

Here are the specific rabbit holes I went down in April:

Macro update

Bitcoin

Ethereum

Smart contract L1s

Stablecoin

Defi

Defi - derivatives

Infrastructure

Other

1 Macro update

Inflation remains top of mind, with CPI hitting 4-decade high in Apr.

Meanwhile, the Fed is hiking rates into recessionary level consumer sentiment (<60)...

Where inflation being a political issue, the Fed has no choice but to tighten, and tighten fast with conviction.

In addition to rate hikes, we can expect to see Quantitative Tightening (QT) commence in May. But what does QT actually mean and how does it affect risk asset prices? I explain here:

The YTD drawdown in bond market has been biblical.

Jim Bianco: The bond market is big, complicated, and opaque. Are we to just assume no "unintended consequences" are unfolding?

The equities market has been lagging fixed income, but is beginning to remember the motto, “don’t fight the Fed.”

Lyn Alden (19 Apr)

My view falls near the middle but towards the secular inflation view.

I expect inflation to be a significant problem throughout the years ahead, but not necessarily in a straight line, and sometimes it will manifest in shortages rather than pure price inflation. There will likely be economic slowdowns, periods of central bank pushback, withdrawn stimulus, and other efforts to control inflation.

If oil prices spike higher this summer due to lack of supply and solid emerging market demand, it can result in inflation (or more precisely, stagflation) that is even higher than my base case. There is a reasonable probability of that happening.

I continue to have a stagflationary view overall. This means an expectation of slow growth, but with persistent inflationary aspects due to supply-side shortages, combined with monetary debasement.

On Fed policy

The Fed is expected to increase their short-term rate by 50 basis points in May and to continue increasing it from there in upcoming meetings every six weeks

Additionally, they have signaled plans to begin quantitative tightening; letting maturing bonds roll off of their balance sheet.

The US economy consists of two-thirds consumer spending, which is tightly correlated with asset prices being high (wealth effect). [Lower asset prices hurt consumer sentiment]

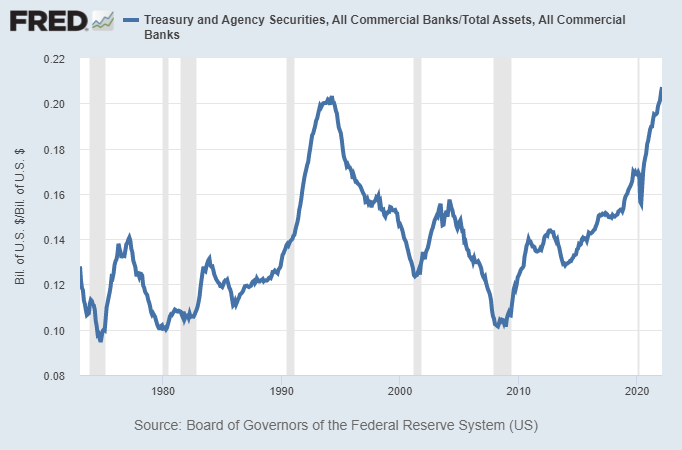

As the Fed tries quantitative tightening, it will mean a lot of Treasury supply is coming to market, with potentially not enough buyers to absorb it all.

Commercial banks have been the biggest buyers of Treasuries aside from the Fed, but they are getting rather stretched here.

Unless hedge funds, pensions, or foreigners pick up their rate of Treasury purchases by a lot, this could get pretty awkward.

The “endgame” for this long-term debt cycle will probably involve the Fed being forced to resume asset purchases even during above-target headline inflation, in order to stabilize the Treasury market, and this could involve yield curve control.

The 2020s decade continues to be defined by de-globalization and supply-side scarcity, in contrast to the globalization and supply-side abundance of prior decades

Felix Zulauf (Dec 2021)

Sees deteriorating global macro liquidity, slowing economy with inflation to peak in Q1 2022 then soften towards 3-4%

Deeper than expected sell-off in global equities (-30% for S&P) during H1 2022, taking commodities down with it

Bond yields to soften by H2 2022

30% equities sell-off (or something of similar magnitude) will force authorities to reverse action course and begin to support the economy

Especially if inflation cools to 3-4% range

This should start the second wave of rising commodity prices, rising inflation and rising equity indices around the world into 2024

Should also set the course for higher bond yields in years thereafter

Capital flows of over $1T into US equities and equity products in the last 12 months equal the flow of the previous 19 years combined, which is an excess you may see only once in a generation.

Commodities: We remain bullish on a secular basis and expect buying opportunities to reappear from Q2 onwards in the individual commodities, once the current correction has run its course.

Gold: Gold price will rise during equities sell-off (with bond yields falling) then go down once authorities reverse course. Sees gold / gold miners to be good hold out to 2028.

Expect more market volatility.

What is liquidity and why does declining liquidity lead to lower risk asset prices? Michael Howell explains.

Arthur Hayes - Doom Loop (27 Apr)

The West’s decision to financially cancel the largest global energy and commodity producer is the biggest advertisement for the existential need of Bitcoin in a sovereign’s currency savings portfolio

A country can do one of three things to finance its deficit:

Sell debt to domestic entities

The central bank can print money and purchase debt issued by the government

Sell debt to foreigners

Germany depends on Russian gas for somewhere between 50% to 60% of their electricity generation.

Even though the EU currently has a current account surplus, that surplus will dissipate quickly if Russia’s energy is cancelled.

If surplus countries, most of which are outside the core Western axis, decide they would rather save in gold, hard commodities, and/or Bitcoin, then they will not purchase Western debt assets (e.g., US Treasuries or Euro member country bonds). Without foreign demand, a combination of options 1 and 2 must be employed to finance the national deficit.

For the US, this will lead to uncomfortably high inflation; for the EU, it will destroy this unnatural monetary (but not fiscal) union. In both cases, the central banks will resort to Yield Curve Control (YCC) to cap yields so that the government can pay its bills in nominal fiat terms. I will repeat– no government EVER voluntarily goes bankrupt. The prescription is always money printing and inflation.…

YCC is the end game.

The actions against Russia all but assure that YCC is coming sooner than you think.

As of January, China was holding just over $1 trillion of its roughly $3 trillion worth of foreign reserves in U.S. Treasurys, according to the U.S. Department of the Treasury. More than half of China’s reserves are denominated in dollars.

The wisdom of this arrangement is now the subject of much internal debate in China, and efforts to sanction-proof its financial system could have far-reaching effects on the global economy

The path of least destruction for those assets is to cease reinvesting maturing bonds back into the Western financial system

They who sell fiat first, sell fiat best. It’s now a race for the exit amongst self-interested flags.

Arthur Hayes - The Q-Trap (12 Apr)

Arthur Hayes remains bearish and sees continued / increasing correlation between Nasdaq and Bitcoin as troubling. He has bought June 2022 puts for crash protection, expecting to see $30k Bitcoin and $2.5k Ether by the end of June 2022.

The market lumps crypto and big tech in the same cesspool.

The short-term (10-day) correlation is high, and the medium term (30-day and 90-day) correlations are moving up and to the right.

[Felix Zulauf’s] general thesis is that the tightening of liquidity globally will lead to a deeeeep, short-term correction in global equities.

[Danielle DiMartino] remarked that when the BBB-rate US corporate 2-year vs. 10-year yield curve inverts, the Fed will spring into action.

The Fed put is not based on equities but on US corporate credit markets, which are still healthy-ish… Watch the BBB 2s / 10s spread for a sign the Fed is about to abort the mission and juice the markets higher once more.

Why inflation matters: In the aftermath of the 1997 Asian financial crisis, every single affected Asian government that had been in place since WWII fell due to rising inflation caused by the crisis.

On why inflation is here to stay: Read the last two truly epic Zoltan Pozar pieces about how difficult and expensive it is to re-route commodities to willing buyers in the Global South now that Europe has cancelled Russian exports. It will leave you convinced that higher prices are here to stay, and global growth — which is a derivative of the cost of energy– must slow. Therefore, slowing growth will take global equities down with…

Bitcoin and Ether will bottom well before the Fed acts and U-turns its policy from tight to loose.

Joseph Wang - Draining the RRP (12 Apr)

The QT timebomb is ticking. When it goes off there will be emergency liquidity operations, and we will move to the YCC end game.

2 BTC

Price range to watch

Currently, I’m watching $38-40k level for support. Note it has been trading inside $38-46k range for 4 months. If it breaks down from here, then $28-33k next. If it holds, $44-46k is next key level to watch.

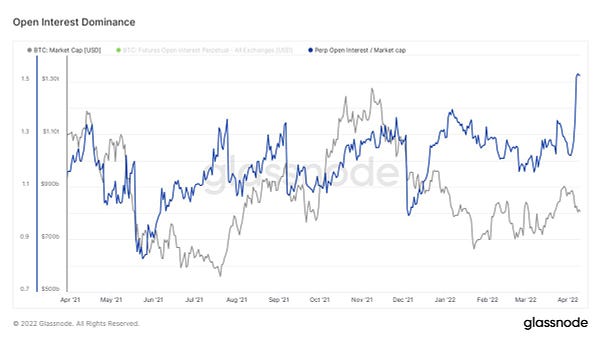

Willy Woo (27 Apr) sees rising dominance of futures market in dictating short term prices

Spot demand for BTC is nearing multi-year highs while price chops sideways, a supply shock is clearly forming.

Unfortunately BTC price is only 10% influenced by spot demand right now. 90% of short term pricing is presently determined by futures traders.

US dollar strength suggests fear, risk off and investors expecting a macro market crash

Short term: BTC is already oversold and is in a typical region of a bottom, yet if equities crash it will certainly trade lower

Long term: We are seeing a supply shock structure develop, with very strong buying that has been unreflected in price. This typically ends in a large bullish price squeeze. But this may take many months to play out.

On decreasing accuracy of prediction: Of interest is how this letter’s accuracy has fallen significantly after October 2021. This is due to the increasing complexity of the BTC market. Futures markets now have the majority of the influence, and these markets can move very quickly. The futures markets continues grow in size, especially since the arrival of futures ETFs traded on Wall Street.

Fidelity plans to add bitcoin as an option for 401(k) in late 2022

Taro looks to bring stablecoin to Bitcoin’s Lightning Network (5 Apr)

Official release:

Taro enables wallet developers to provide users with USD-denominated balance, on top of BTC, in the same wallet

This structure taps into the network effects and liquidity of today’s Lightning Network to route any number of assets, avoiding the need to bootstrap an entirely new network for new assets, and ensuring that bitcoin underpins all transactions on the network. It also incentivizes the growth of BTC liquidity within the Lightning Network to serve a broader multi-asset Lightning Network.

Made possible by Taproot upgrade.

Lyn Alden takes:

Lightning Labs announced a $70 million Series B capital raise, along with a new specification called Taro which if successful will allow multiple asset types to be issued on the Bitcoin/Lightning network

The most notable feature will probably be for stablecoins; users will be able to send stablecoins instantly and nearly for free. It could also technically be used for NFTs or wrapped versions of other blockchain tokens or any particular allowable security, if users want to do so.

Having stablecoins running over Lightning channels is a powerful combination, because payments using Lightning are instant and cheap, and if users stick to stablecoins they can avoid the capital gains tax problem of paying with bitcoins. A bunch of point-of-sale companies integrating with Lightning is separately quite good as well.

Having a network of instant and nearly-free transactions across multiple asset types, including self-custodied bearer assets, that can be programmed with all sorts of multi-signature use-cases, represents another set of building blocks that really won’t matter on the grand scale for years, but that in the long run looks extremely interesting.

3 ETH

Arthur Hayes pontificates $10k ETH by end of 2022 (1 Apr)

ETH 2.0 Merge

Ethereum developers announced plans to delay the Merge until autumn 2022.

Though the Merge got plenty of attention this month, I am fading ETH price action near term given we know that the merge is delayed and I expect prevailing macro headwinds to overwhelm any positive sentiment re the Merge.

Protocol results

Defi ecosystem results

NFT ecosystem results

L2 ecosystem results

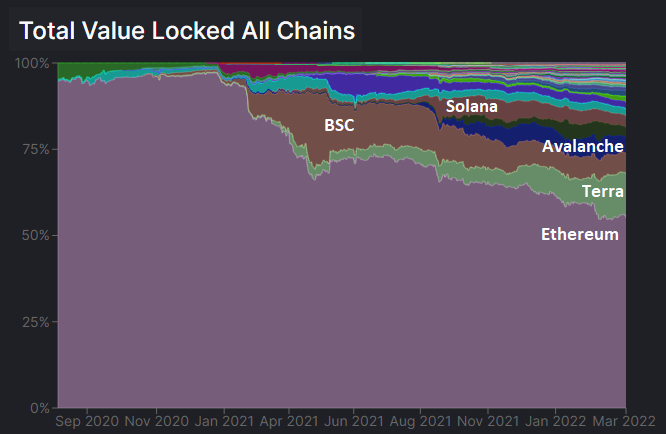

4 Smart contract L1s

Lyn Alden (3 Apr)

Competition is heating up in the smart contract space.

“Distributed compute” is a rather commoditized service, and usage of this service should disperse into cheaper platforms over time, which is indeed what we’re seeing.

Overall, I continue to be somewhat bullish on the more scalable smart contract chains (Solana, Avalanche, Terra, etc) relative to Ethereum for the intermediate term. Users primarily seem to favor a better user experience and low fees, rather than maximizing decentralization, for these types of use-cases. In the long run, I consider all of these types of coins to be speculative digital equities.

5 Stablecoin

I believe 4pool is the most significant development in crypto this month. Here’s the TLDR:

Building on 4pool, here are reasons to be bullish on $FXS:

$LUNA and $FXS are not so different, though the simplicity of Anchor’s 20% interest account has better catalyzed $UST growth to date. In contrast, it takes a gigabrain to understand all of Frax’s pegging and profit making mechanics. But the Delphi article linked above does a decent job.

I sold my $FPIS airdrop (from staking cvxFXS) at $11.20 given 1) poor macro conditions and 2) $FXS seems the better bet vs $FPIS.

Fireblocks adds institutional support for Terra given “record breaking” demand

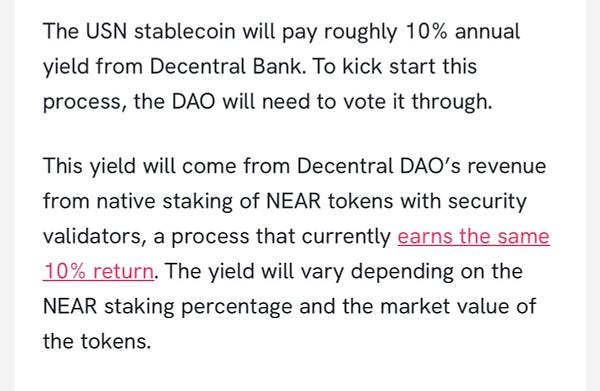

The success of UST adoption via Anchor has attracted copy cats. Near ecosystem has launched its own stablecoin (USN), but with 10% APY. I will likely have a play.

Justin Sun is attempting a copypasta on Tron via USDD. I will most likely steer clear, given my reservations about Justin Sun’s character.

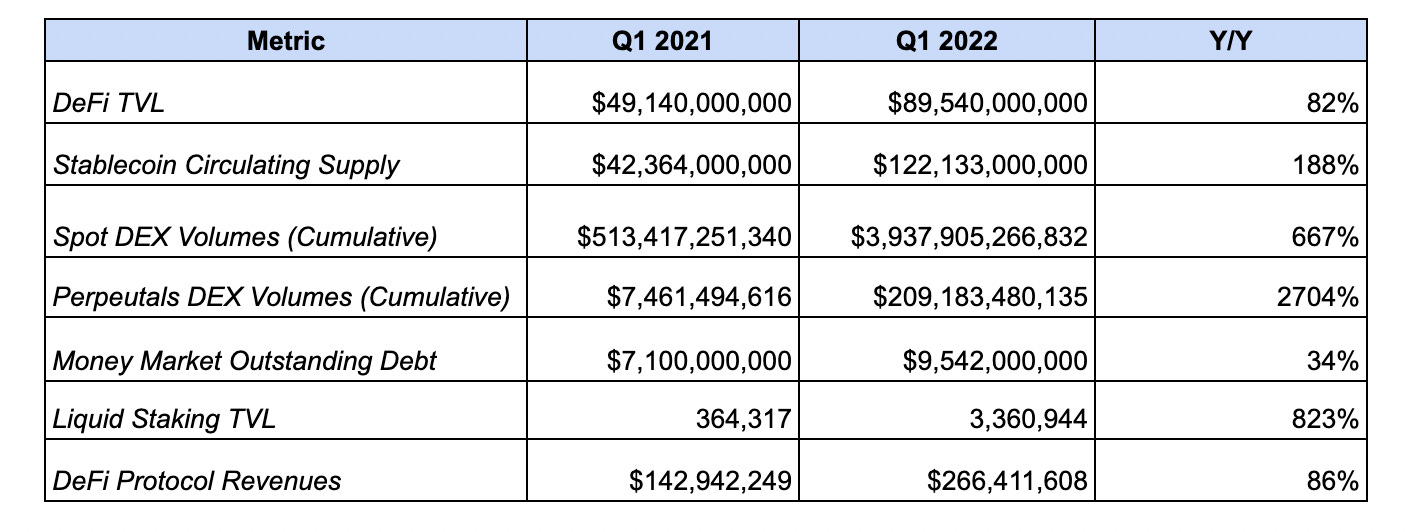

6 Defi

Lifinity ($LFNTY)

I will write a thread soon on why I invested in $LFNTY, which currently accounts for 3% of my portfolio. TLDR:

revenue generating project

continued innovation

strong token value accrual design and tokenomics.

Saber ($SBR) / Sunny Aggregator ($SUNNY)

sunSBR is here, the equivalent of cvxCRV on Solana. I have been converting my $SBR to $sunSBR to farm $SUNNY. For a crude comparison:

Saber has a current FDV of $209m vs Curve FDV of $6.8b (or 33x)

Sunny has a FDV of $26m vs Convex FDV of $2.3b (or 87x).

Currently, sunSBR is the 2nd $SBR largest locker, holding 23% of Saber’s governance voting power.

Layer Zero / Stargate (STG)

LayerZero explained, with seals.

Santiago articulated the core value proposition of LayerZero. Bridges are complicated and the UI/UX sucks. I’d hate to see a Defi future where users have to manually understand how to wrap and unwrap a dozen different types of the same tokens across multiple chains.

CowSwap ($COW)

I’m not invested in $COW and see this “Meta DEX” as an important piece of the plumbing for Defi, given it:

protects against MEV attacks

enables ETHless transactions

provides best-in-class spreads via Coincidence of Wants / batch auction mechanisms.

Anyone not in a hurry to execute their orders should consider trading via CowSwap.

7 Defi - derivatives

Growing dominance of perps - 25 Apr

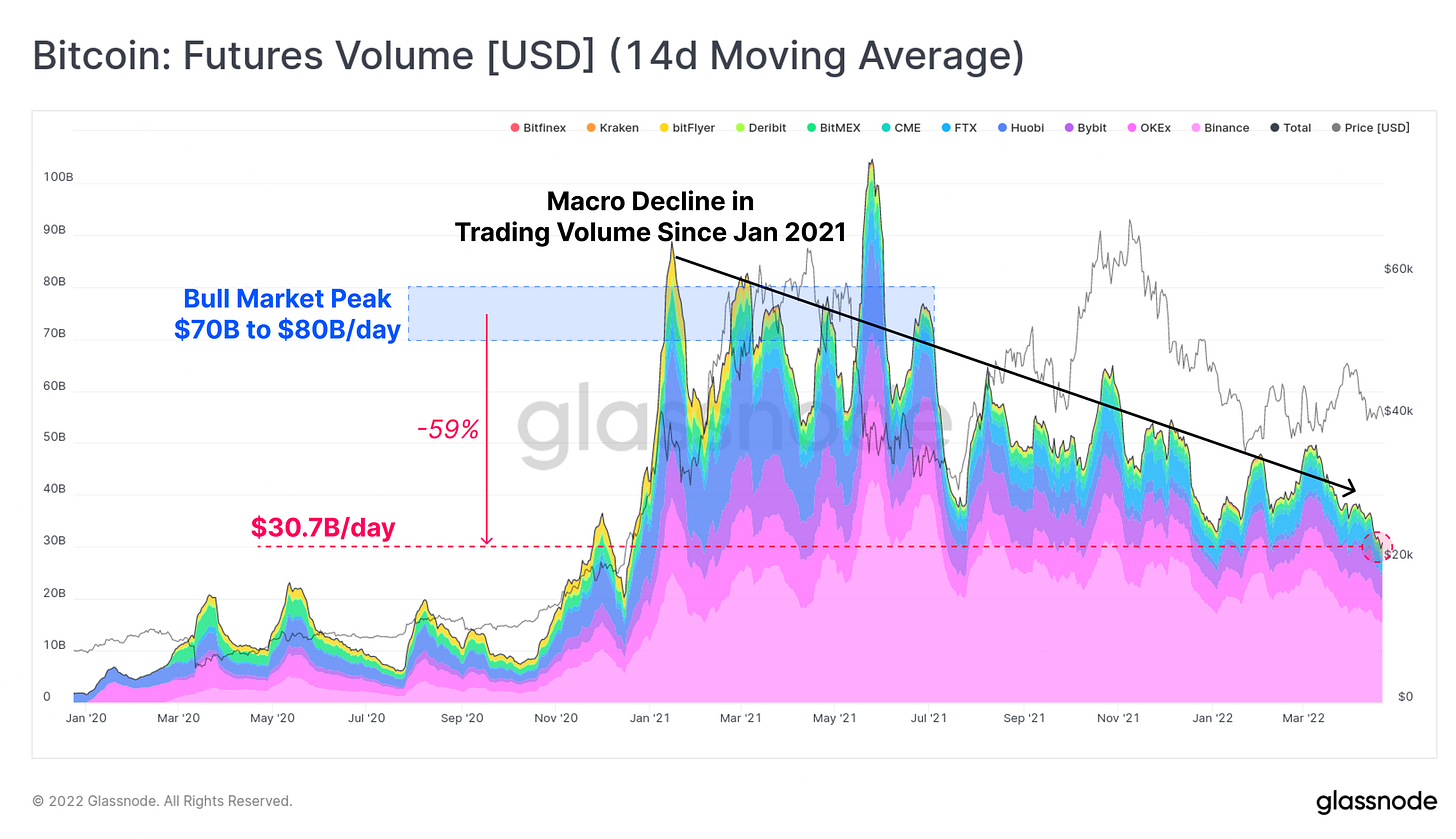

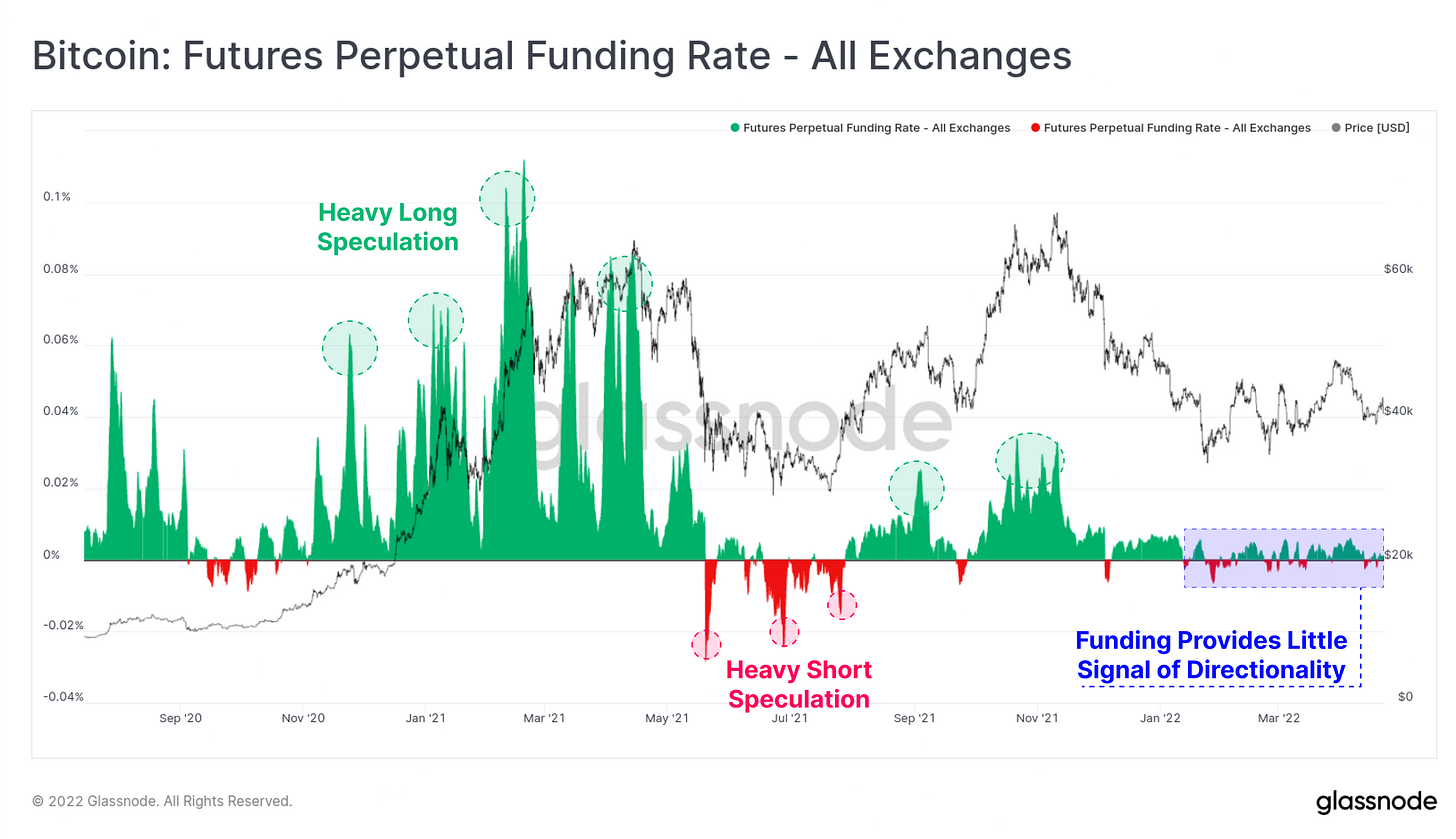

Willy Woo sees that 90% of short term pricing is presently determined by futures traders. Perpetual futures (perps) are increasingly becoming the preferred instrument for trading. So let’s examine what’s going on with perps.

Aggregate futures trade volume has been in decline since Jan 2021, down ~60% vs H1 2021 average.

We have seen a distinct shift in the preferred instrument away from calendar expiring futures, and towards perps, which is expected given the ease of price interpretation, and low storage and delivery costs of digital assets

Meanwhile, funding rates have remained very subdued since the start of 2022, as seen by low yields and lack of directional bias…

…while options market is showing historically low implied volatility.

Typically, we can expect to see violent moves following a sustained period of subdued activities. Key question is when.

Dopex ($DPX)

Single Staking Options Vault (SSOV) v3 sees refinements to on-chain options trading by introducing flexible expiries and deposits and tokenizing deposits into ERC721 tokens to unlock secondary market liquidity. All welcome changes.

Options is largely untapped in Defi still, as seen from the continued dominance of perps volume. Macro conditions made me exit $DPX. I look forward to buying $DPX back at lower prices and building up a meaningful position. Current price of $850 is beginning to interest me.

GMX ($GMX)

GMX announced X4: Protocol Controlled Exchange. This is too gigabrain for me, will need some time to digest and test the product once it’s ready.

GMX offers a great treasury management asset called $GLP on Arbitrum or Avalanche, especially for the current market conditions. Issue is that few people understand GMX and GLP token design, so here’s a explainer:

7 Infrastructure

Pocket Network ($POKT)

$POKT fell ~50% in last 30d, to $0.37 at one point on May 2. Meanwhile, daily relays remains near ATH at 823m and staked $POKT supply continues to trend up. If someone can enlighten me as to where all this sell pressure is coming from, that would be appreciated…

GenesysGo ($SHDW)

$SHDW has shown strength in an otherwise ugly April, up 50% in last 30d. For anyone bullish NFTs on Solana, don’t sleep on Shadow Drive, Frank (CEO) & the team of strong builders at GenesysGo.

8 Other

My favourite read this month is a speech by Peter Kaufman on “the multi-disciplinary approach to thinking”. Though, when you peel back the onion, it’s really about how to live a meaningful and fulfilled life:

6529 offers some advice for surviving the turbulent times ahead:

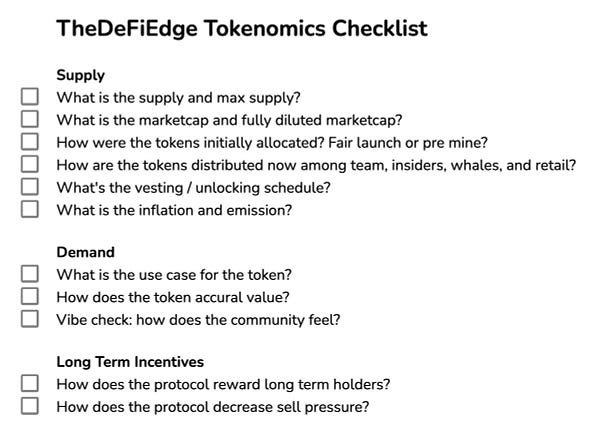

As a crypto investor, it’s important to be crystal clear on concepts like market cap, fully diluted value (FDV), token unlock and circulating supply because:

Jordi offers a useful mental model for weighing market cap vs FDV when evaluating a project:

Complete this checklist before your next ape:

Concise life alpha from Cobie’s guests and Sahil Bloom:

Kyle’s mental model for decision making and why it often pays to optimize for a single variable:

Cobie - Apecoin and the death of staking (22 Apr)

Staking mechanisms should be designed to support the goals of the ecosystem. They should be used to incentivise the parts of a product, community or network that requires people to do work or to take risk.

When POS protocols issue rewards to stakers, they are buying chain security…When DeFi projects offer liquidity mining programs, they are buying growth and TVL. Depending on how the program is designed, it can also be a worthwhile use of equity.

Simply paying users for not selling, payment received in the same asset that they are not selling, seems like pretty late-stage in the games of ponzi creation.

The people who 'vote' for the "free money" coins will see their nominal holdings rise while their dollar holdings fall once insiders can dump.

This month’s funny. Scary because it’s (mostly) true:

Contact me

Twitter: EtherKai @btc21m

Email: kai.btc21m@gmail.com

About Kai

Bought the 2017 top, fell down the crypto rabbit hole in 2020, full-time Magical Internet Money HODLer & User since. Prior: a decade in TradFi (renewables/investment banking/capital markets).

Thank you

@cobie @Pentosh1 @CryptoHayes @zhusu @hasufl @Arthur_0x @FedGuy12 @KyleSamani @mrjasonchoi @woonomic @jdorman81 @Rewkang @LynAldenContact @RaoulGMI @DegenSpartan @100trillionUSD @RyanSAdams @richwgalvin @finematics @santiagoroel @nic_carter @grapeprotocol @panicselling @EPBResearch @SBF_FTX @aeyakovenko @Delphi_Digital @biancoresearch

Disclaimer

This memo is presented for informational and entertainment purposes only and does not constitute financial advice. Individuals have unique circumstances, goals and risk tolerances, so please do your own research before making investment decisions.

Tough times create strong men.