Some housekeeping: The name of the newsletter is now Ether Kai Issue # (Date). It is now available with audio. The newsletter will be structured into three sections moving forward:

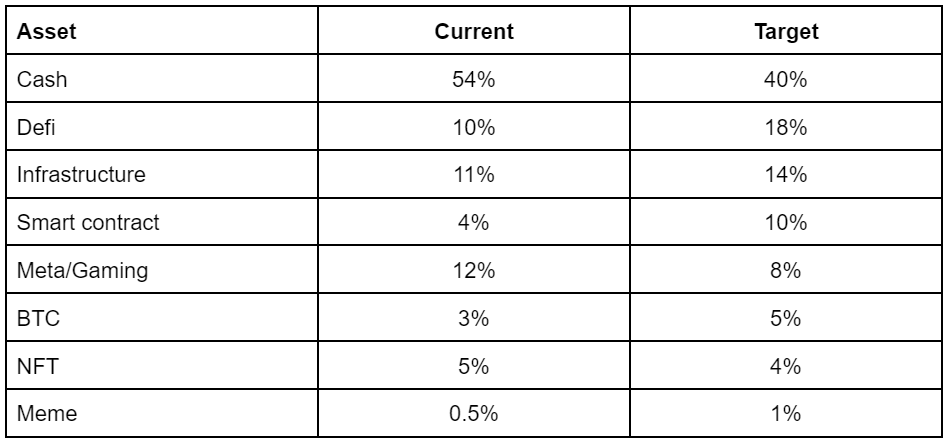

Portfolio allocation update will document changes to my crypto holdings each month

Main update will be the key section to pay attention to

Key trends and opportunities will be a numbered section, where you can skip around and read only what interests you.

Now, let’s dive in.

Portfolio allocation update

Bought $BTC via weekly DCA

Accumulated small bags of $STG and $GMX

Redeemed $IN for USDC as the sun sets on Invictus (Ohm fork on Solana)

Cash % down mostly because the market went up.

Main update

3 month outlook

We are seeing the first signs of capital rotating back into the crypto with TOTAL back above $2T, after 19 weeks down trend. Bears exhausted, bulls want to play.

For retail plebs like us, having ample cash reserve and a disciplined risk management plan remain key. This is not the time to go full ape.

Darius Dale on Blockworks did a great job in articulating the key difference between the current investing environment vs the period that was Nov 2020 to Nov 2021.

TLDR: the confluence of 5 factors made Nov 2020-Nov 2021 one of the easiest periods to make money. These factors included rising economic growth, rising corporate profit growth, rising inflation, QE and fiscal stimulus. Combined, it catalyzed hell of a bull run.

Fast forward to today, we are looking at the complete reversal of all 5 of these indicators likely beginning Q3 2022, with the possible exception of inflation due to war, continued supply chain disruptions and Covid. Applying the same logic implies that there’s plenty of reasons to be bearish heading into H2 2022.

Consequently, any moves I make will be more of a trade than a medium-long term hold position at this juncture. I will also be looking to derisk, reduce positions and rotate back into majors, if Q2 2022 offers an opportunity via relief rally.

We can now add Russia/Ukraine to the equation. Applying probabilistic thinking, we're nowhere near out of the woods when considering all the possible scenarios that can play out from the war. This is because when it comes to geopolitics, nobody knows. It’s difficult to assign probability as we're dealing with human psychology at the individual level (eg Putin, Zelensky), and we simply don't know how these individuals will act. If there is no peace deal and the war extends, my bet is that Putin will escalate given it's an existential matter for the ex-KGB boss.

My near term outlook is relief rally, then lower. It largely aligns with Tascha’s views in her latest post: Sustainable Rally or Dead Cat Bounce?

TLDR: BTC maybe pump to $50k+ in the near term, ahead of the next FOMC meeting in early May, with ALTs following. But don’t expect much of that rally to sustain. Tascha said she’d be surprised if we don’t see BTC <$30k in next 6-9m (Q3-Q4 2022). In other words, we probably haven’t seen this cycle’s low yet.

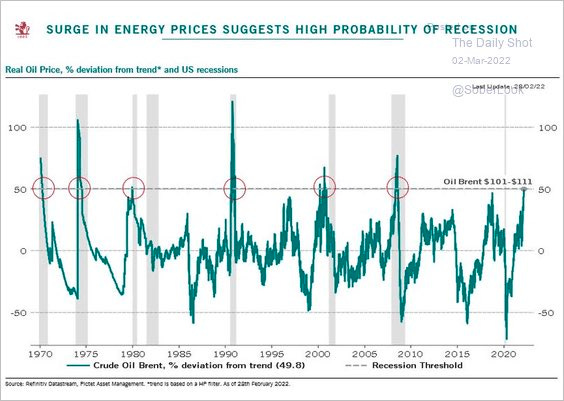

Why? 1) monetary conditions will only tighten from here. If the S&P doesn’t fall (which it isn’t right now), it only leaves room for the Fed to be MORE aggressive in its tightening 2) inflation and high energy prices will be here to stay for the foreseeable future, squeezing disposable income, 3) activity on blockchain is net decreasing as retail have all but lost interest, 4) bullish catalysts like BTC offering financial sovereignty and institutional crypto adoption are gradual processes that take time to translate to higher prices 5) an economic recession forcing the Fed to reverse course is possible, but unlikely in next 6-9m.

Potential moves

In terms of specific opportunities, my conviction is highest in BTC. Now is the time for the use case / narrative of BTC to take center stage. At the same time, I am aware that in a “correlation 1” type event (as Arthur Hayes calls it), BTC will follow big tech into the latrine.

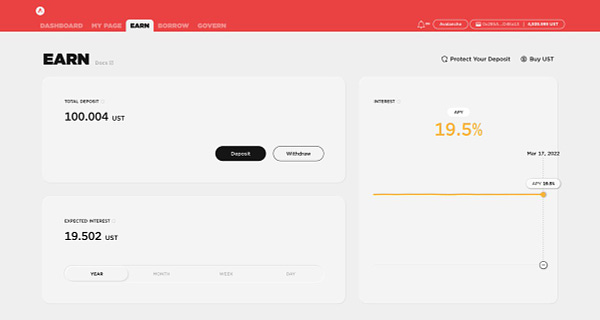

Because I believe this cycle’s low is not in, I have not rotated heavily back to BTC. I have been weekly DCAing into BTC from Anchor UST yield instead. Any position I decide to add to BTC will be a short term trade at this point. If you wish to add here, just be mindful of becoming exit liquidity for those who accumulated at mid 30k level and expected bearish economic indicators from Q3 2022 onwards.

I am contemplating adding allocation to ETH ahead of the merge. If the merge is to occur in June 2022, this could be good timing as the positive catalysts may overwhelm the macro bearish conditions for a period. FWIW Ansem believes Lido is the better r/r play if u want to trade the merge.

I will likely trim my ALT positions (even my high conviction one’s) if we get a decent pump here, rotating into stables or BTC.

I have covered Layer Zero in earlier issues and bullish on the project. Layer Zero beta is now live and they have launched the first product building on the base layer called Stargate. I participated in Stargate bonding, having missed out on the auction. Since 2 whales took up the entire auction allocation, Stargate decided to do a subsequent community auction round, which I will be participating in. This means a small allocation of STG @ $0.25 locked for a year. Good r/r imo.

Here are reasons to be bullish and bearish for you to make up your own mind:

Reasons to be bullish

Luna Foundation Guard (LFG) seems to have bought $1.3B of BTC and is looking to accumulate $1.7B more in the near term, and potentially another ~$7B over time to create a $10B+ BTC reserve to defend UST peg. This incentives front running by speculators and has driven bullish PA for BTC

Notably, the narrative (BTC as reserve asset for crypto projects like LUNA) has been welcomed by BTC high profilers like Pomp, PlanB and Dan Held, because it’s good for BTC NgU technology.

ETHBTC is breaking out of a 3m downtrend, hinting at ALTS pump in near term. I see this as a opportunity to offload any low conviction smaller caps in the near term.

Memecoins: We are seeing the first signs of memecoins pumping, a space that has been left for dead for months.

ALTS: selective ALTS still showing strength, validating the mini bull markets in broader bear market thesis. We’ve seen strong PA out of STG, LUNA, JUNO, OSMO in the past months. But not easy picking winners.

S&P / NASDAQ have both been on the mend, dismissing the Fed tightening (rate hikes / QT plans to be finalised by May 22), the war and expected economic slowdown ahead. Looks like mean revert here, though I’m inclined to fade equities price action as a signal, especially as the bond market is singing to a different tune.

S&P was down 15% from its peak, now down only 4%

NASDAQ saw a 25% drawdown from ATH, now sitting at 16%

Lack of uncertainty is bullish: There is not much more news to be bearish about. The market doesn’t care what the news is. It can process good and bad news equally efficiently. It just can't deal with uncertainty, but most bearish news are certain at this stage.

Ansem Q2 update (16 Mar):

pretty certain we’ve bottomed here, expect relief rally here to lower highs then more consolidation. this will offer a chance to derisk most things towards end of Q2

expect crypto to lead recovery if investment sentiment on macro improves, we've seen peak of fear and expect accumulation ranges to break upwards in Q2, led by BTC and few alt outperformers.

if BTC fails to do well against current macro backdrop, then it has failed in its intended use case.

on ALTS: we've seen most retail investors leave, evidenced by low eth gas fees and lack of derivativs premium.

on trigger for re-entry: bid btc reclaim of YO 46k or 30k (2021 summer capitulation)

Willy Woo BTC forecast (25 Mar):

sees both calendar futures yields and onchain spot demand strengthening

significant evidence that macro bottom is in

consolidation below 44k then up, price grinds up but expect choppy conditions (no clean squeeze)

Tascha (27 Feb):

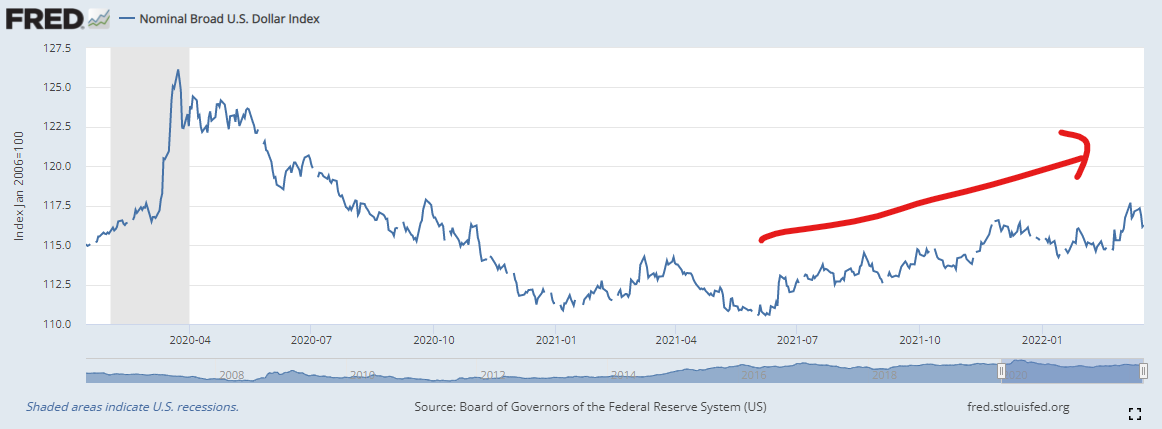

my baseline is short-to-mid term mkt rebound w/ heightened volatility, but by end of [2022], QT well on its way, DXY further up, crypto further down

short to mid term rebound especially if positive news out of Ukraine

Raoul Pal (21 Feb):

we know that equities get spooked around the change in policy and stumble, but regardless of whether it’s a full tightening cycle or not, equities rally sharply to new highs after that 16% to 18% correction

Is it possible that the NDX makes one more low? It is quite possible for sure, but the key contextual takeaway is that the rate shock is nearly done

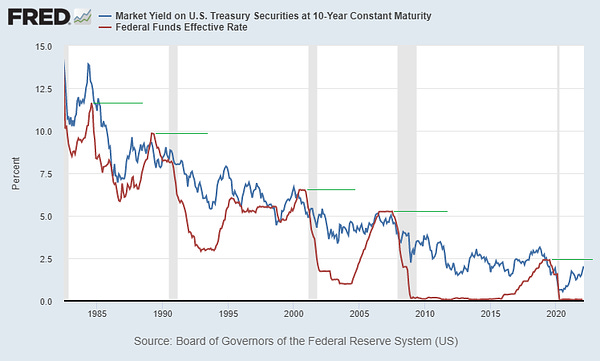

But with only 60bp left in the curve, how long can the Fed stop QE before the yield curve inverts? This is going to be the big issue in 2022 – the curve heading to zero

Everything I look at suggests a sharp slowdown is coming, along with a rapid moderation in inflation

we must be buyers in extended weakness; they get “cheaper” every day they don’t increase in price if the technological advancement and network effects continue to accelerate.

Reasons to be bearish

USD dollar:

High DXY is bad for risk assets. $ up = crypto down.

Some point out it’s more JPY / EUR weakness, not USD strength, but trade weighted USD index has also been trending up since Jun 21.

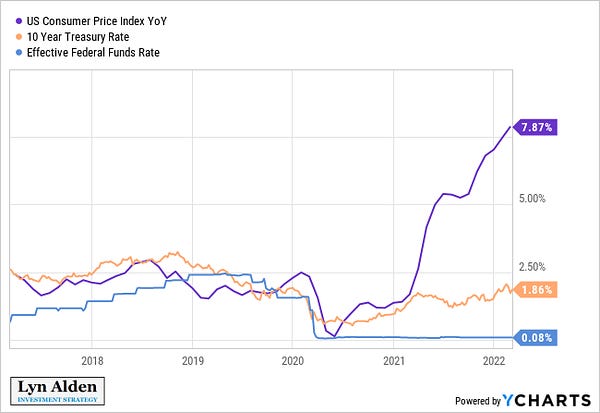

Lyn Alden (March 2022 premium newsletters):

what Russia has done is far outside of my base case

global maths doesn’t work without Russian exports. there may be a solution to cut Russia out of the global supply equation, but it will take at least a year and higher prices to make the transition.

there is a long list of real things to be bearish about. any bullishness I have for most assts this year is moderate at best, expect a lot of chop.

on BTC: breaking above 46k would make the chart look a lot better, breaking down 37k would make the chart a mess.

Btc tends to be somewhat canary in the coal mine, leading S&P

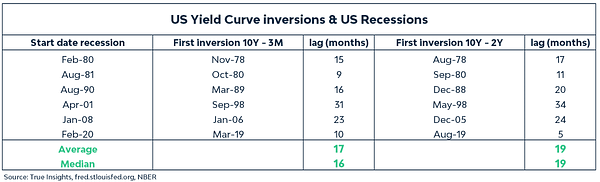

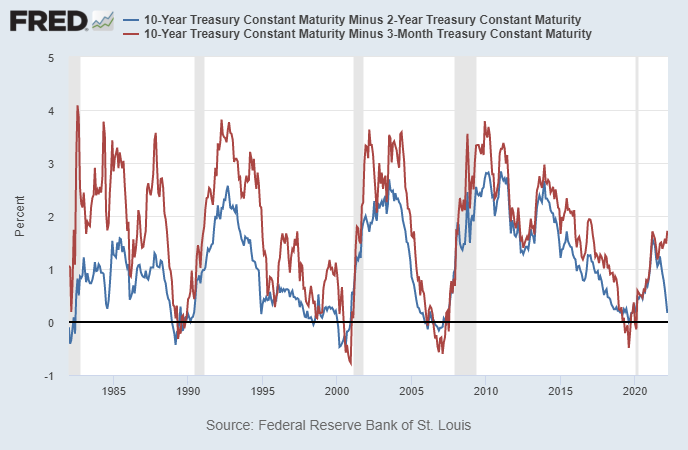

Bond yield spread:

10Y-2Y has narrowed sharply and quickly, -140bps since Mar 2021 peak and -63bps since start of 2022. It current sits at 3bps.

An inverted yield curve has reliably signaled past recessions. The last time the yield curve inverted was in Sep 2019, followed by recession in Feb 2020 (5m lag).

The Fed: stagflation environment is inherently hard for central banks to manage. First rate hike of 25bps is done. Now, Fed is tightening into a slowing economy if you believe leading indicators. Eurodollar futures pricing in 10 more hikes by Mar 23, which will take rates to >3%s. Bond traders aside, I believe the broader market (equities, crypto) hasn’t priced in the effects of QT at all.

Russia/Ukraine: Great unknown is the war. Commodity is a cyclical market and investment in hydrocarbons was already way behind schedule. Sanctions on Russia point to higher energy prices (which leads to recession) and commodity/food supply disruptions (sustained inflation and famine if the war persists). We've seen real disfunction in commodity trading already when LME halted trading and retroactively cancelling transactions, after the move left some brokers unable to cover margin calls.

Ray Dalio thoughts on war (5 Mar 22):

NATO and Russia has roughly comparable military capability and nuclear, odds favour no hot war between NATO and Russia in foreseeable future.

But this we know: hot wars never go as planned with outcome worse than imagined, the winner isn't the most powerful, but the one who can endure the most pain for longest (in this regard, Russia/China is stronger than the west)

Arthur Hayes - Energy Cancelled (17 Mar 22):

100% certain on financial crisis of epic proportions predicated on losses faced by commodity producers and traders.

Russia exports most raw energy globally (mostly hydrocarbons) and is one of the largest producers of foodstuffs. We cannot cancel the largest energy producer without consequences.

Bretton Woods is gone with confiscation of Russia fiat reserves by US/EU and removal of certain Russian banks from SWIFT.

Fed has far and away becoming THE buyer of US debt that both Americans and foreigners don't want to touch.

Gold: Expect much higher gold prices in long term, but slow/creeping appreciation coupled with bouts of extreme downside volatility in short term.

BTC: currently tied at the hip with big tech risk assets, will follow big tech into selloff if equities tank. If we believe nominal rates will go higher and cause an equities bear market and an economic recession, Bitcoin will follow big tech into the latrine. Only way out of this is a narrative break: a rip roaring bull market in gold in face of rising nominal rates and global stagflation will break this rship.

On real rates: must be deeply negative for years, raising nominal rates is theatrical performance.

How to play:

If horizon is in years, it's time [to buy BTC].

If savvy trader, correlation 1 moment to come, all assets will get dumped, but believes BTC and crypto will emerge from carnage first.

Raoul Pal (28 Feb)

I really want to buy tech but think it’s too risky. Buying TLT (long bond) instead.

Key trends and opportunities

Here are the specific trends and opportunities I’m monitoring, feel free to skip around:

Macro update

BTC

ETH

LUNA / UST / LFG

Layer Zero / Stargate (STG)

Lifinity (LFNTY)

Defi - portfolio allocation, crypto security, DPIWETH, Cronje, Cashio/Saber hack

Decentralized derivatives (GMX, DPX)

Infrastructure (SHDW, POKT)

Web3 (JEWEL, PUNKS, BAYC)

Parting words

1 Macro update

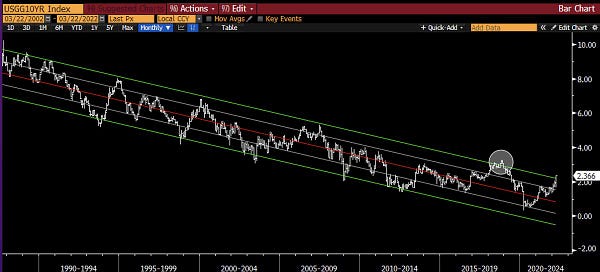

US 10 year is signaling potential regime change

Raoul calls this 10-year US bond yield log chat the “chart of truth”, with 2 standard deviation being ~2.25%. We’ve broken pass this level recently.

This 2.5% is particularly significant as it could signal a regime change if we stay above this level, as Lyn explains.

Yield curve

A little history lesson on the importance of 10y-3m yield curve and how it played catch up to 10y-2y back in 1994:

The 10y-2y yield curve is more famous, but the original studies about the predictive power of the yield curve focus on the 10y-3m yield curve and that is the one with the slightly stronger track record. The current divergence between the two looks similar to how it did in early 1994, which is also when the Fed began hiking rates for a cycle. Back then, the 10y-3m curve eventually caught down to the 10y-2y curve by the end of the year.

A historical look at yield curve inversion and the impact it had on the S&P:

TLDR:

Yield curve inversion signals poor economic conditions, and leads recessions

Recession coincides with financial market crashes

Market crashes forces Fed to lower rates and (more recently) conduct QE, to help economy & financial markets recover

Yield curve has inverted 9 times since 1969

8/9 times, inversions have led to recessions

Lead time can be 6-24m from inversion to recession

Average S&P500 drawdown was -34% during recessionary periods

Duration of crash varied from flash crash (1-3m) to slow & steady (1-2yr)

7/8 times, S&P bottomed during recessionary period, before going on to make new highs

From the bottom, S&P either made a new high quickly (3-5m) or took its sweet time (4yrs+)

Covid crash (Feb 20) was swift, down -35% in 3 weeks before making new high 3m later (Aug 20), due to aggressive monetary and fiscal policy response

Today, US10Y-US2Y sits at 3bps while US10Y-US3M sits at 183bps

Inflation

US short-term interest rate is the furthest below CPI since 1951. Got some serious catching up to do.

Geopolitics

Peter Zeihan may be a little sensationalist in his interview but does make you think about what much worse things could get.

Darius Dale (28 Mar 22 ) takes on macro

medium term, asset prices havent priced in slowdown yet, mostly because growth slowdown hasn’t materialised yet. Consensus will begin to see slowdown come H2 2022 (May-July 2022 timeframe)

short term, most ppl are still bearish, usually signals good time to buy, risk is to the upside

lack of fresh bearish catalysts = bullish

growth slowing + Fed tightening into slowdown = long term bond up. but bond hasn’t performed, could be due to secular trend towards higher inflation in latter half of 2020s decade (is cyclical inflation becoming secular?)

5 bullish things all happened at same time from Oct/Nov 2020 to Nov 2021: accelerating economic growth, inflation, corporate profit growth + QE + Fiscal easing. Expect all 5 indicators to turn negative come H2 2022: this is very bearish, especially for high beta assets

Fed is tightening into slowdown, the only thing that will cause Fed to reverse course is a clear sign is financial conditions become so tight that the obvious conclusion is that inflation is going to decelerate rapidly, most likely Q3/Q4 event

unlikely that inflation will come down fast enough to a level that is acceptable before something breaks - this is why correction in asset market prices needs to be the feedback mechanism to tell the Fed to stop tightening

if the market can message to the Fed by fall (Sep to Nov 2022), then we can even avoid a recession, but the later the asset price crashes, the more likely we will have a recession

Fed put works equally in the opposite direction. If asset prices do not fall, it gives room for the Fed to tighten faster and more aggressively

expect 30-35% drop in S&P from ATH

never seen unemployment as low and yield curve as narrow before Fed raised rates. Fed is beginning this time way too late.

Gold: outperforms when there is an economic slowdown, best place to be when fed is tightening into slowdown

BTC: the Qs it's not whether BTC did well during periods of QE or QT, but was the Fed tightening (QT) into economic acceleration or deceleration? BTC does well even if Fed tightens into economic acceleration. But that is not the case today

near term looks like btc wants to break up given lack of negative news, probability is higher of near term breakout

All-in Podcast E73 (26 Mar) focuses on late stage VC valuation markdowns, but the lessons and insights apply equally to crypto given it’s a high beta industry

internet companies valuation (EV/ NTM EBITDA) hit ATH during Covid (40x), now reverting back to historical mean (14x)

tech/growth / saas companies multiples getting repriced (to down side) 30-60% since it topped out Feb 2021

in momemnts of uncertainty and high volatility, expect flight to quality, all the "nice to own" projects will underperform

late stage private financing market is closed for business. sellers arent willing to accept reprice, buyers arent willing to pay covid time premium. so stalemate

need to weight r/r against "risk-free equity rate of return" of ~8% (S&P with dividend reinvested) over long-term

more projects will have to IPO at down rounds, at lesser valuation than their last private round

when rates are at 0%, ppl willing to pay 8x revenue (top line), for every 100bps increase in rates, valution decrease by 15-20%

so if rates going from 25bps to 250-300bps, at minimum we need to write down valuation by 30-40%

Silicon Valley is full of companies that are walking dead and they dont even know it

the law of economic gravity is interest rate and inflation. this time is not that much different, as it turns out

FAANG will jack up cost of customer acquisition (input cost) by 20-40%, because they need to maintain their profitability / bottom line. this will come at the demise of smaller companies that rely on these costs to grow

we're at the beginning of the process of unwinding the market distortion by govt and central banks since Covid

in this market, quality doesnt matter, its all going down in a correlation 1 moment

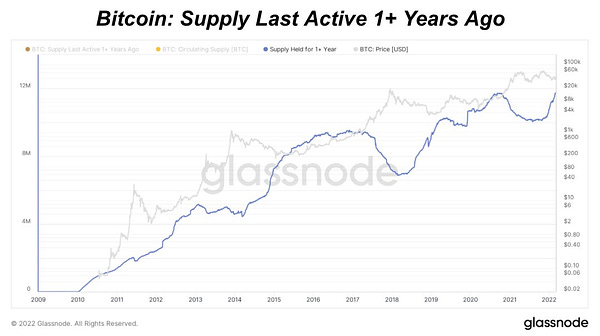

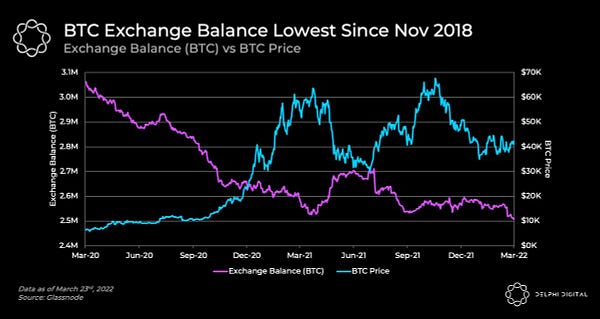

2 BTC

Good reminder on why bitcoin matters.

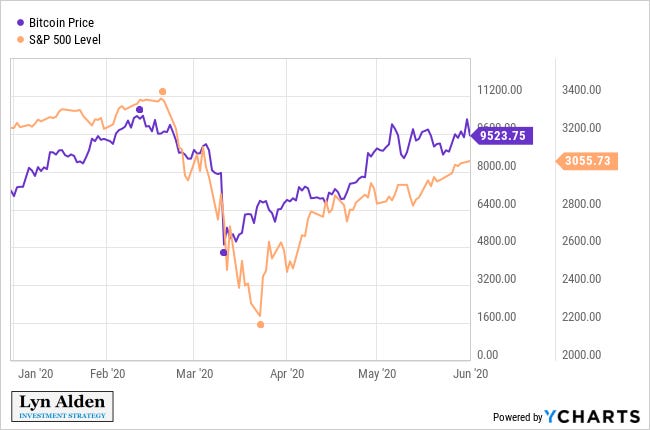

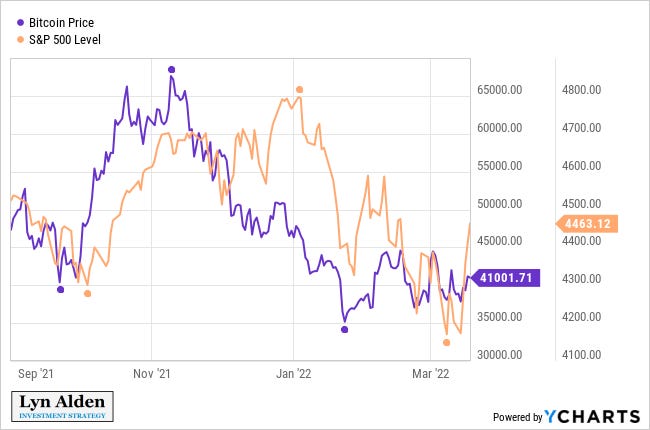

Bitcoin tends to be somewhat of a canary in the coalmine for other risk assets, including the broad S&P 500. It led the bottoming in Mar 2020…

…and the topping in Nov 2021.

Supply remains tight

3 ETH

ETH merge is getting talked about.

G is either bullish ETH or bullish leaving things alone or both. I align with the gneral sentiment that for most of us, the more we do, the lower our net worth. Especially true in a bear market.

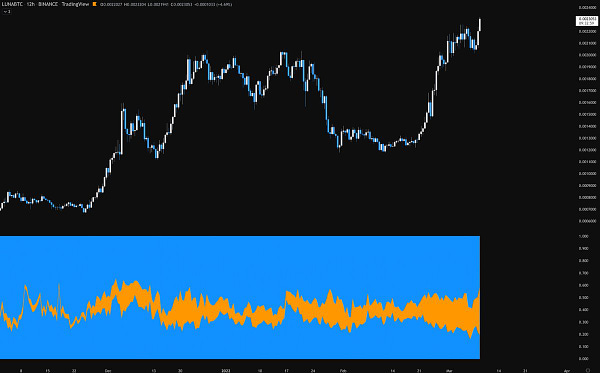

4 LUNA / UST

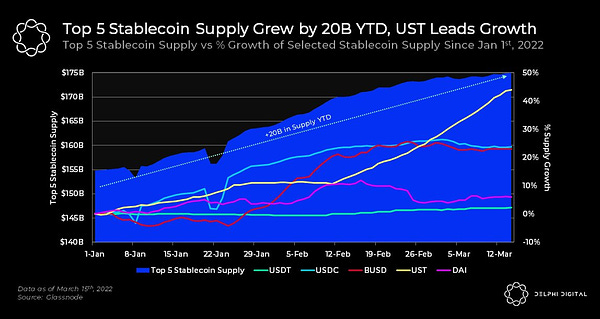

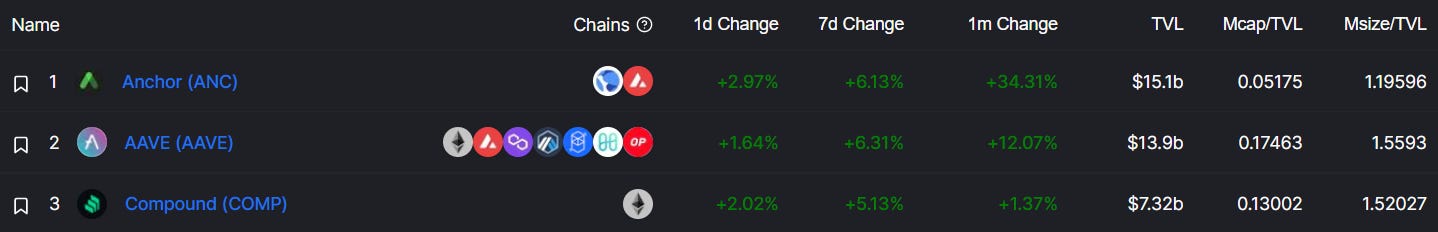

Anchor has overtaken AAVE for the number 1 spot in lending TVL.

Even bear market conditions couldn’t fade $LUNA…

…nor continued growth in UST supply.

BTC reserve to defend UST peg

Kwon announced plans to add $10B+ in BTC reserve to defend UST peg. To get you up to speed quickly, here’s what the Luna Foundation Guard (LFG) has been up to since establishing in Jan 2022:

LFG is funded via $LUNA grant and $1B of external institutional capital (Jump, 3AC, Republic, GCR, Tribe, DeFiance et al)

As of 15 Mar, total reserve assets = $2.2B (non-LUNA assets) + 8m LUNA ($0.76B) = roughly $3B

Feb: announced $1bn of external capital raised will be used to buy BTC

5 Mar: announced burn of 5m LUNA to mint $450m to buy BTC

14 Mar: Do says he wants >$10b in BTC reserve, to be used for short term redemption of UST

15 Mar: announced burn of 4m LUNA to mint $372m exogenous reserve assets

24 Mar: Jump proposed LFG reserve pool to be deployed to defend UST, with the proposed size of the pool being $2.5B at launch

I will just note that the relationship is both ways. As more BTC reserves are used to defend UST peg, this is great on the way up and not great on the way down.

Anchor now live on Avalanche with sAVAX added as collateral, bATOM to follow

Anchor will move to Dynamic Earn Rate from current 19.5% flat rate

Initial min and max earn rate will be set at 15% and 20% respectively.

AAVE adds UST

Positive for UST adoption. Not a surprise that the current take up isn’t high given Anchor is still offering higher interest.

5 Layer Zero / Stargate ($STG)

LayerZero (beta) is live and the team wasted no time launching its first project, Stargate, bridging infrastructure that allows users to transfer stablecoins across 7 EVM chains to begin with. Stargate attracted >$3B in TVL since launching Mar 18. 0xMaki has joined as head of BD. Not too shabby.

6 Lifinity Protocol (LFNTY)

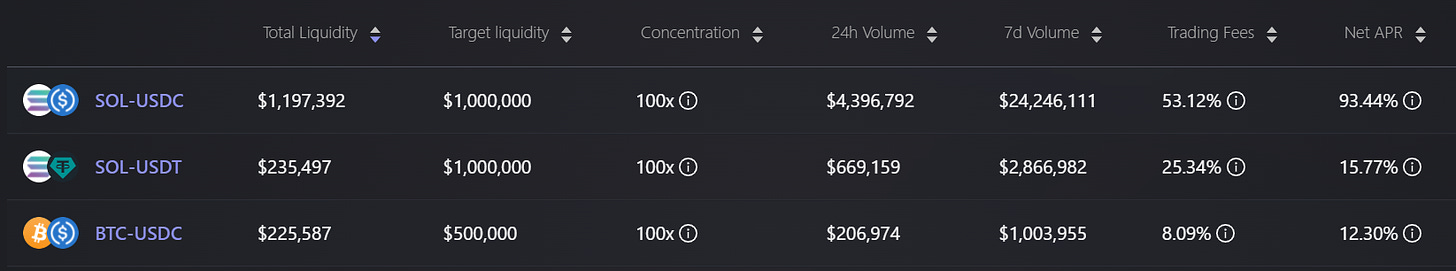

Lifinity worth paying attention to, especially if you like revenue generating protocols. Lifinity is a DEX powered by swap aggregation engine and proactive market making algorithm. It has some big brain Uniswap V3 + Pyth price oracle design that not only minimizes IL, but can actually make money for LPs via price arbitrage.

The market making design is rather capital efficient...

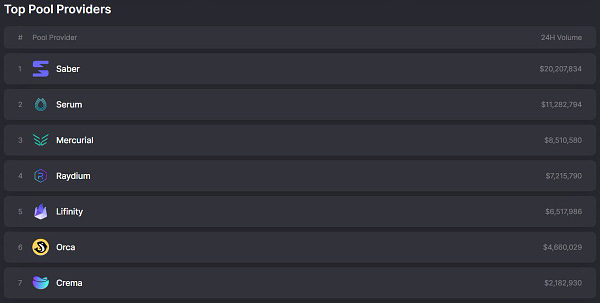

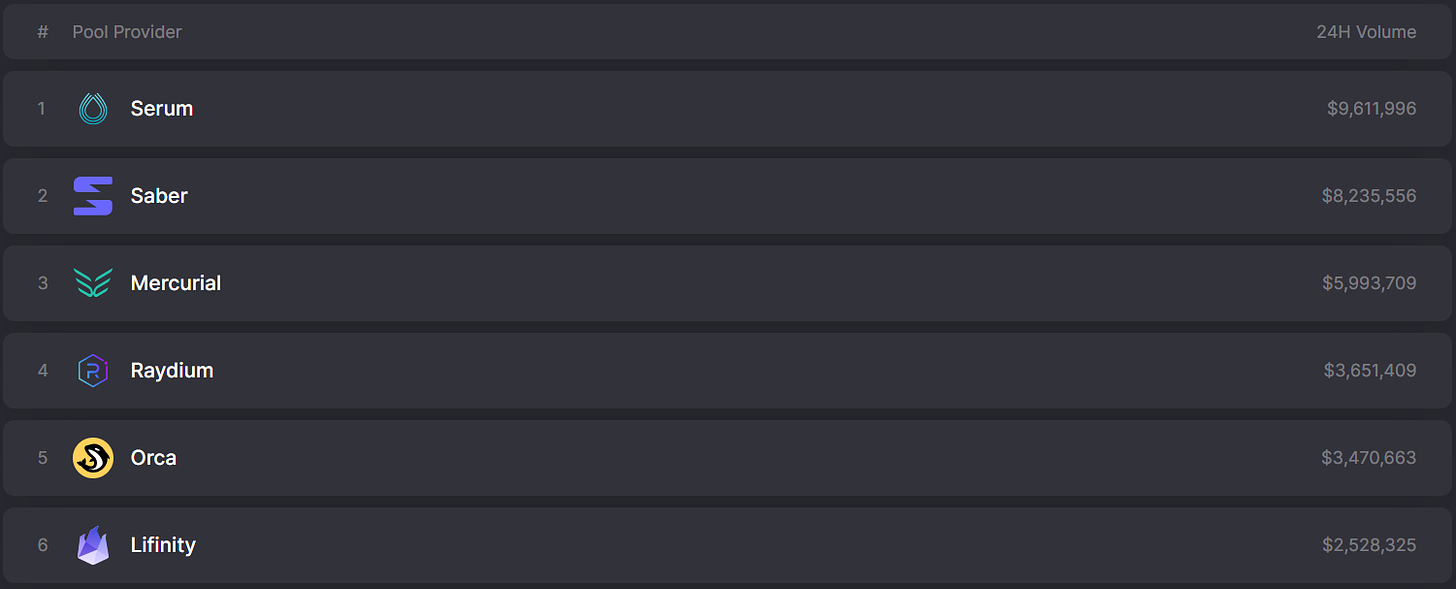

…and it consistently ranks 6th in 24H volume on Jupiter from its $2m TVL.

Instead of losing money from IL, SOL-USDC pair has made ~40% APY in market making arbitrage profit on top of trading fees for LPs.

Drawing and iterating upon the best models in Defi, Lifinity has a thoughtful tokenomic design that looks to accrue value to LFNTY holders and LFNTY flare NFT holders. It has no VC backing and its IDO is on 9 Apr 22. I will be monitoring.

7 Defi - other

Defi Edge is a new CT account that I’ve been following. He built a 100k+ audience in a few months by offering actionable, no bullshit alpha. Much respect. Here are some of my highlights from his CT this month:

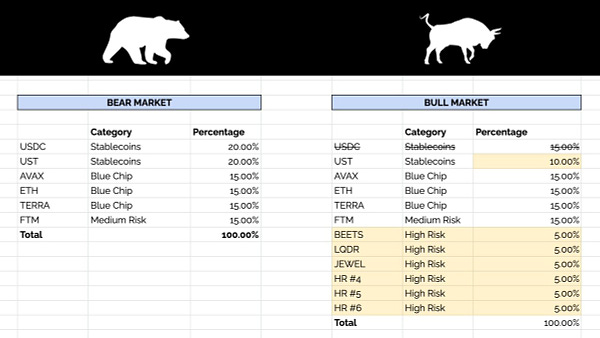

Bull vs bear market portfolio allocation

Crypto security best practice

Common mistakes to avoid

DPIWETH

Defi index is down ~80% against ETH since Mar 2021. I do not expect this trend to reverse heading into ETH merge.

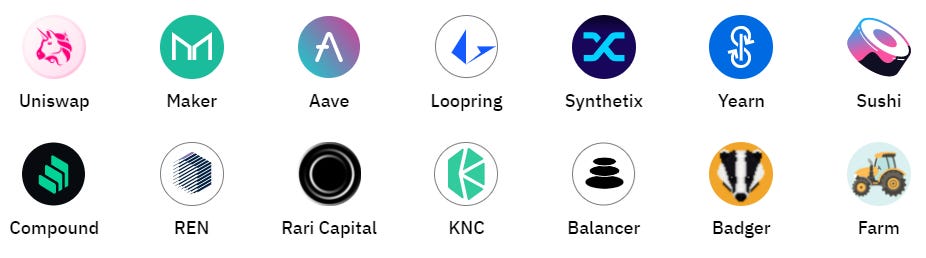

Projects that make up the DPI index:

Andre Cronje rage quits defi/crypto

Did this really happen in March? Feels like 2021 when I panic withdrew from Solidly...

Good explainer on the situation

Cashio hack, Saber ($SBR) needs to step up

Cashio hack puts into question the ethos of build fast, break fast at Saber Labs. When one of the highest profile projects on Solana (Saber) actively promotes an affiliated project (Cashio), driving significant liquidity to its LP, and then $52m gets stolen via sloppy codes, community is right to be angry. Saber’s official postmortem is also the worst I’ve seen, which was subsequently deleted and replaced with this more reasonable one. Time to step up Saber Labs.

8 Decentralized derivatives

GMX (GMX)

This is the most comprehensive research on $GMX I’ve come across. Bullish decentralized trading still.

Dopex (DPX)

Bullish decentralised, composable options. No one has cracked this space while Deribit dominates BTC / ETH options volume on CEX.

9 Infrastructure

Pick-and-shovel projects have not been performing well lately but GenesysGo is quietly building away in the background…do not sleep on Shadow Drive, which requires users to stake $SHDW for decentralized storage.

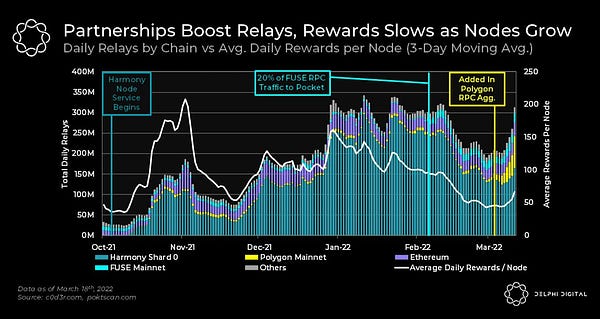

Meanwhile, Pocket Network relay growth is at ATH, driven by support for new chains and relays from Polygon reaching 1B+. Its price action caught a bid recently, up 50% in last 30 days.

As POKT transitions from its Bootstrap phase to Growth phase, it is also updating its inflation schedule. The new Weighted Annual Gross Max Inflation (WAGMI) proposal passed. TLDR POKT emission will reduce over time, from a target inflation rate of 100% in Feb 2022 to 50% by Jul 2022. Later when the project transitions from Growth phase to Maturation phase, the community will vote to burn the POKT staked.

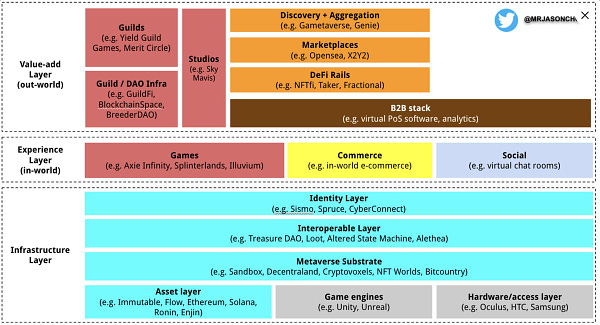

10 Web3 / metaverse

Defi Kingdoms ($JEWEL)

Defi Kingdom gets its own chain for Crystalvale expansion and is the first project to be granted incentives under Avalanche’s $290m (4m $AVAX) Multiverse program.

Mental framework for Web3

Path to mass metaverse adoption remains unclear

Yuga bought CryptoPunks, giving full commercial rights to punk holders.

Raoul’s thesis for coming around to buying BAYC is worth a read.

TLDR future lies in social tokens, the kind that is get rich slowly IF the community builds utility that has long-lasting value.

Quirky NFTs

11 Parting words

You can’t do everything in this life time, but you can do just about anything.

Nobody knows anything is probably the most liberating insight I got in my 20s.

Remember to spend quality time with your loved one’s. We’ll all be gone in a minute.

Contact me

Twitter: EtherKai @btc21m

Email: kai.btc21m@gmail.com

About Kai

Bought the 2017 top, fell down the crypto rabbit hole in 2020, full-time Magical Internet Money HODLer & User since. Prior: a decade in TradFi (renewables/investment banking/capital markets).

Thank you

@cobie @Pentosh1 @CryptoHayes @zhusu @hasufl @Arthur_0x @FedGuy12 @KyleSamani @mrjasonchoi @woonomic @jdorman81 @Rewkang @LynAldenContact @RaoulGMI @DegenSpartan @100trillionUSD @RyanSAdams @richwgalvin @finematics @santiagoroel @nic_carter @grapeprotocol @panicselling @EPBResearch @SBF_FTX @aeyakovenko @Delphi_Digital @biancoresearch

Disclaimer

This memo is presented for informational and entertainment purposes only and does not constitute financial advice. Individuals have unique circumstances, goals and risk tolerances, so please do your own research before making investment decisions.

Relief rally, then lower.