Main update

Words current trending on Crypto Twitter:

Capitulation.

Contagion.

Worst on record.

I chose these words for the title of this issue because months and years from now, when we look back, I want to recall the sentiment and feelings of those of us who survived these brutal market conditions.

The lower the prices get, the more bullish I become, given my long-term conviction in the value of bitcoin and the inevitability of crypto adoption hasn’t waned. I believe opportunities are abound for those of us who continue to pay attention.

However, it’s important that we approach the coming months with level-headed observation and patient accumulation. We’ve never lived through a period where the economy is headed into a recession (high probability event), with 4 decade-high inflation and interest rate close to zero bound. There is no playbook for where we’re headed and the probability of outcomes before us has never been harder to ascertain. We must therefore proceed with great humility.

I’m a fan of buying oscillator extremes and playing mean reversion. The risk-reward of accumulating BTC & company isn’t shabby at the current levels, and so I parted ways with some fiat to accumulate magic internet money this month. Overall, I deployed ~14% cash in June, and have ~50% cash remaining to deploy into further weakness.

Macro

Multiple economic indicators continue to point towards recession, or at least significant economic deceleration/stagnation.

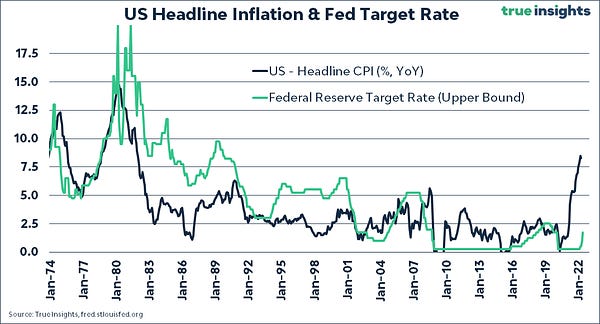

Inflation rose to 40-year high of 8.6% in June, above expectation. In response, the Fed hiked rates by 75bps to 1.75%:

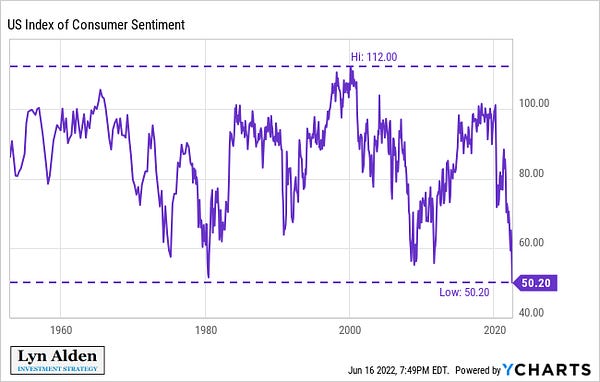

US consumer sentiment is at its worst on record:

Until energy is abundant and cheap again, and/or wages are rising faster than inflation, consumer sentiment likely won’t be very high.

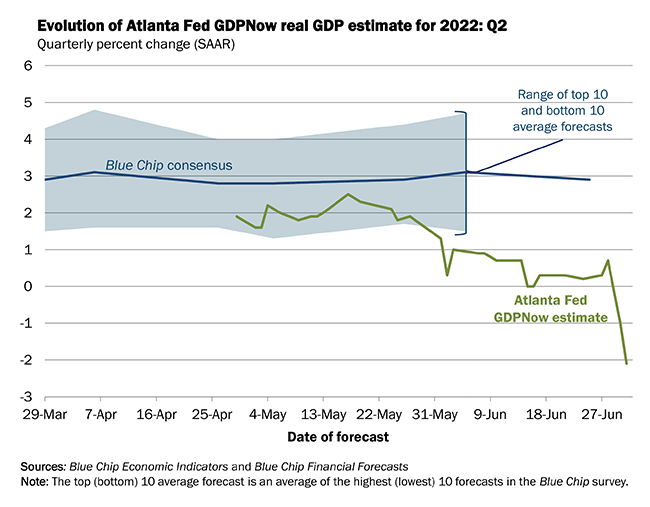

GDP estimate for Q2 2022 is now pointing sharply negative:

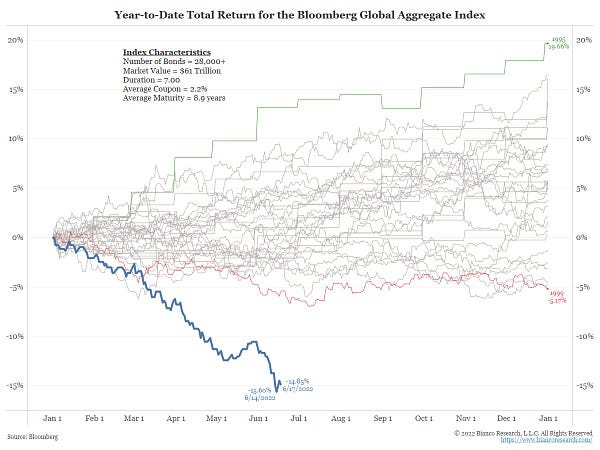

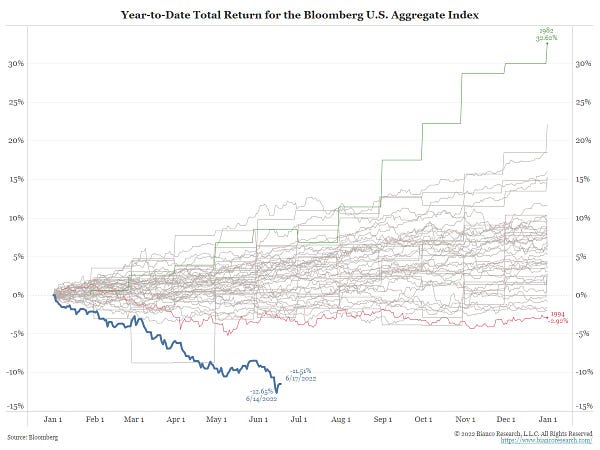

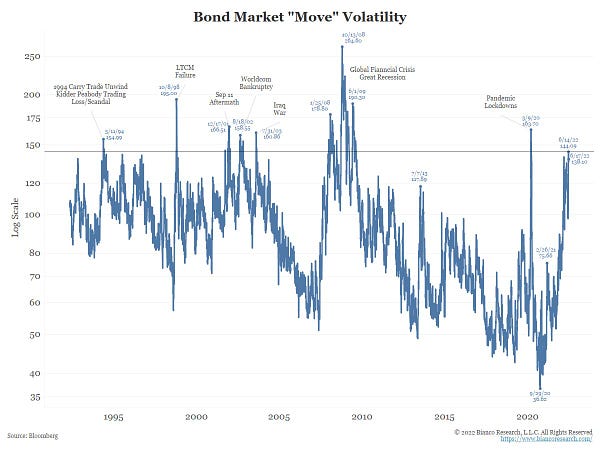

Bond continues its worst YTD performance, while bond volatility remain at levels where bad shit has happened in the past.

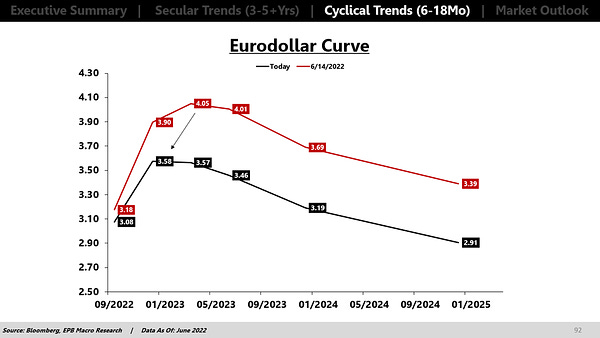

It’s possible that market expectation of Fed hawkishness has peaked, with peak Fed Funds rate beginning to get priced lower and to occur sooner vs. few weeks ago.

If we see market expectations of forward Fed rate hikes hit a peak and roll over, that could be a key bullish catalyst on rate-sensitive assets prior to the Fed’s actual pause on rate hikes. The Fed is likely unable to tighten as quickly as the market expects, especially by the end of this year, due to increasing recession risk, stressed credit markets by then, and the high level of debt in the system.

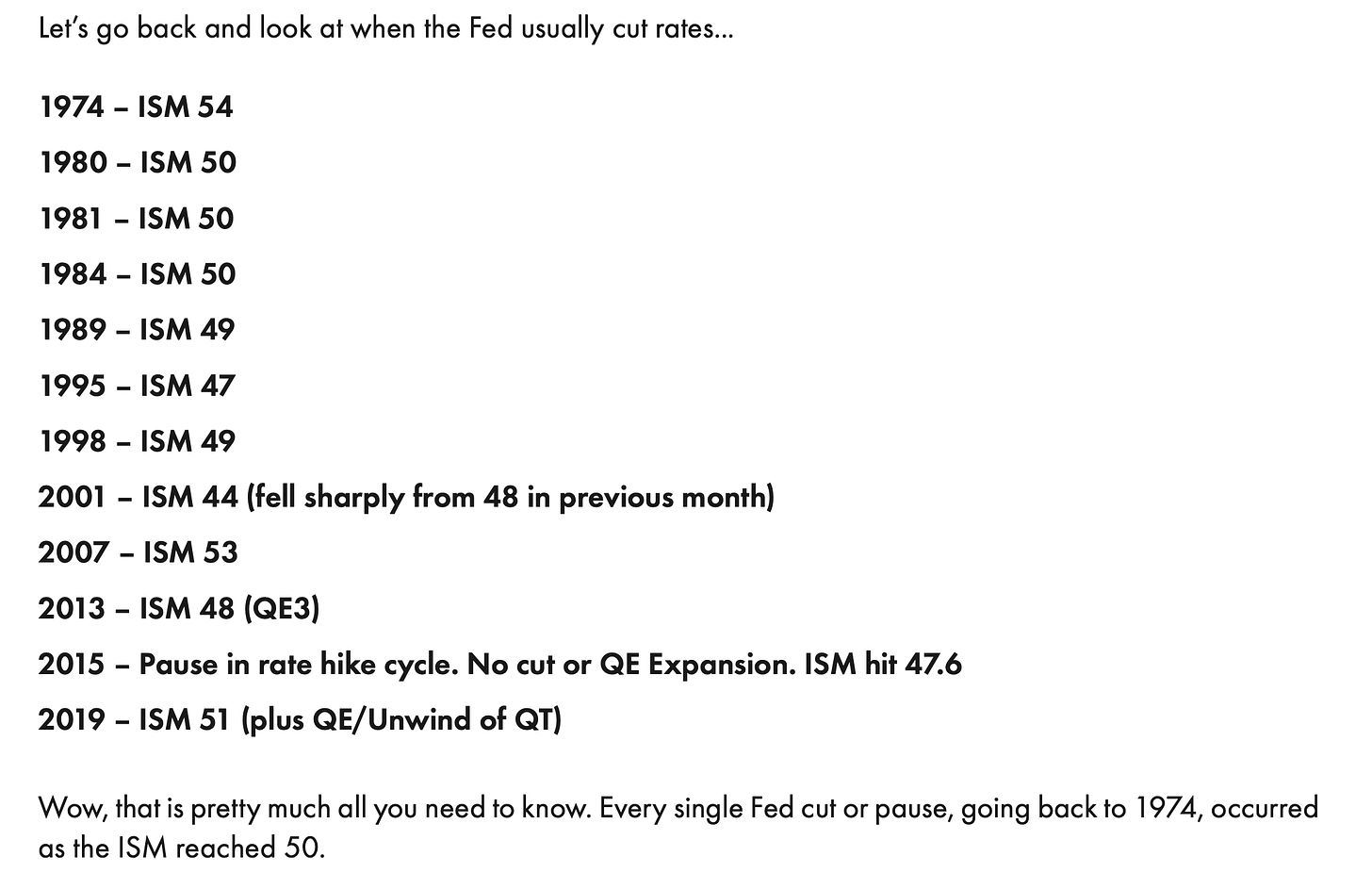

ISM crossing <50 has also put considerable pressure on the Fed to cut rates in the past.

Looking ahead, we have never entered a recession with inflation this high and rates this close to zero bound.

Takeaway: Proceed with patience and humility.

Crypto

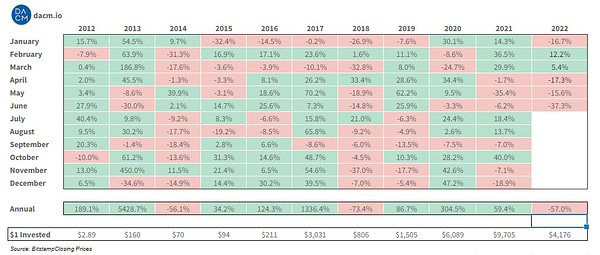

To sum up June 2022, BTC saw its worst month on record, worst quarter on record and worst start to a year. Meanwhile, you could’ve bought ETH at $1971 and lost 55% of your money 18 days later. I added ETH at $1650 thinking it was a bargain, only to add again at $950…

Looking ahead, people have not a clue where prices will bottom.

Importantly, June saw the continued contagion from LUNA’s collapse, with the Goliath of the industry - Three Arrows Capital (3AC) - getting 100% REKT before ghosting its lenders. Here is a more detailed list of affected institutions for those interested.

Each day, more information comes to light revealing the poor risk management practices at “reputable” crypto lending platforms many of us have come to know and trust. With everyone seemingly crowding into the same trade at the same time, the market showed no mercy on anyone who didn’t manage your risk.

Arthur pontificates on what might have happened with 3AC that got us here:

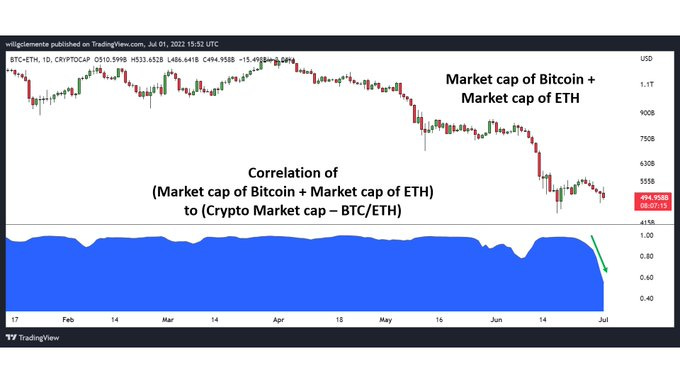

Interestingly, BTC dominance fell from 48% to 43% in June and we saw declining correlation of BTC/ETH to ALTS. This likely signals that the recent capitulation is led by institutions, with the most liquid assets being sold off the most.

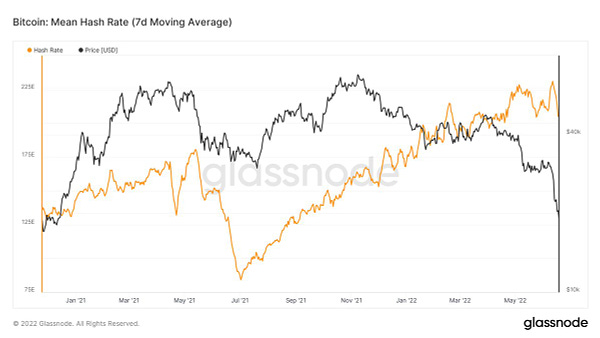

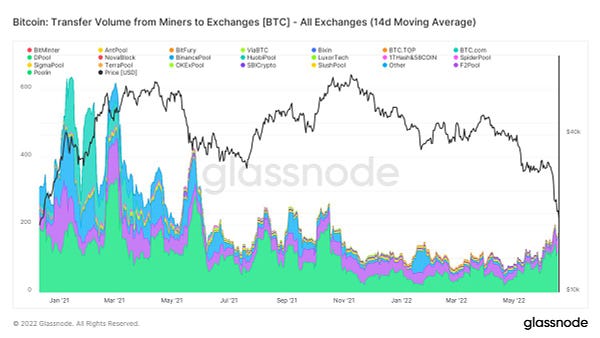

Early signs of miner capitulation is also emerging as prices break below 2018 ATH ($20k). How? Miners typically pledge hardware as collateral to take out a loan to run their businesses. If bitcoin prices fall below production cost, cost of running business exceeds revenue and banks may be forced to repossess hardware if miners default on payments. This process typically takes a long time to resolve.

Wen moon?

Timing wise, the domino effects flowing from the collapse of LUNA has reset my expectation of how quickly and how hard we bounce back. For the time being, my base case is that every relief rally will be sold into and the crypto market will take months to reset its foundation.

It’s better risk-reward to sit tight and prepare a shopping list. There is ample time to get back in and make a killing when macro conditions inevitably recover and all forced sellers get flushed out of the system.

It doesn’t take a genius to tell you that in most likelihood, the bulk of the bearish price action is now done. The real question is when and how fast we turbo back from here.

Personally, I’m sticking my nose close to the macro landscape and steadily planting the seeds for future harvest.

Specific trends and opportunities

Here are the specific rabbit holes I went down in June:

Macro update

BTC

ETC

SOL

Defi (LFNTY)

Infrastructure (SHDW)

Other - cross chain bridges, on-chain analytics, “funds are safu”

1 Macro update

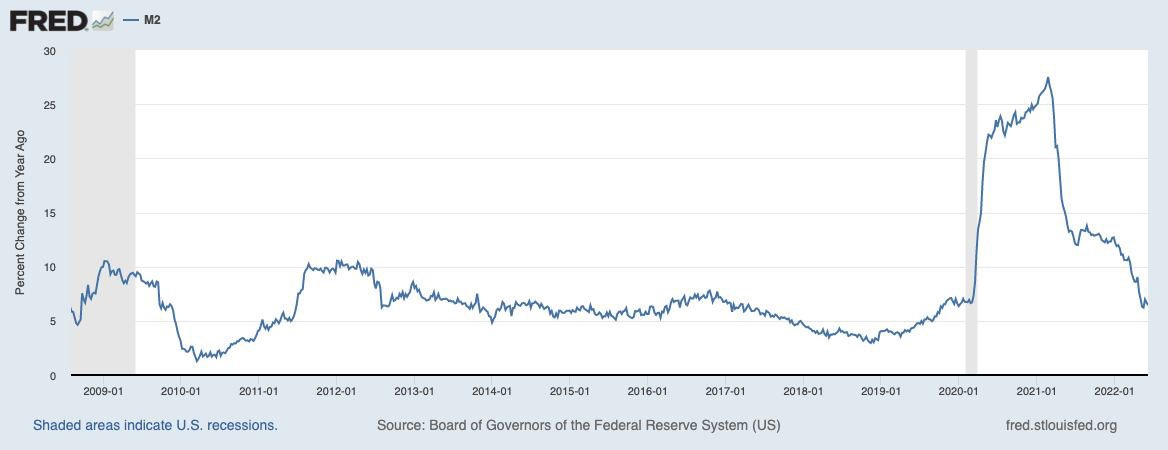

In hindsight, it can be argued that it was all ONE TRADE, a trade on the unprecedentedly loose monetary policy since the beginning of Covid-19:

Lyn Alden May 2022 newsletter

I think the Fed will probably get some signals to stop tightening monetary policy prior to hitting very high levels, once something in financial markets breaks. And I think that will happen before they reach 3% short-term interest rates, and/or before $1 trillion is off the balance sheet, but we’ll see.

Overall, my base case is that the Fed will tighten monetary policy until something breaks, which will force them to reverse course. It might be a recession, or it might be a near-recession slowdown.

This chart shows the Fed’s interest rate, with recession shaded gray with red dots. Each time, the Fed is able to tighten monetary policy less than the previous cycle. If the Fed is forced to stop tightening this time, while inflation still runs hot due to supply-side shortages, then we’ll have effectively entered a new policy regime.

Entering global central bank checkmate

I think major central banks including the Federal Reserve, Bank of England, European Central Bank, and Bank of Japan are nearing the losing side of a checkmate scenario, where economic realities dwindle their set of possible choices to zero. The latter two have likely already been put in checkmate.

“Checkmate” in this context happens when a central bank encounters inflation that is above its target level, but still can’t stop printing money, due to lack of buyers of their country’s government debt, or due to other critical liquidity problems in their financial markets.

The fact that both the Bank of Japan and the European Central Bank are forced to continue monetizing government debt even when inflation is above their target in order to keep government bond yields at serviceable levels, is basically checkmate on their policy.

The UK and the US both have sovereign debt over 100% of GDP, and total sovereign + private debt of between 300% and 400% of GDP.

2 BTC

BTC as a hedge against money supply growth

Contrary to popular belief, Bitcoin is a hedge against global money supply growth, not inflation. This makes sense to me because inflation is a lagging indicator and inflation often doesn’t peak until we’re already in a recession.

The chart below complements this theory well. Currently, global liquidity has all but been drained. I expect bitcoin to outperform all other asset classes once again when the liquidity returns.

Here is a funky chart that complements the above theory:

Accumulating BTC here = good risk-reward

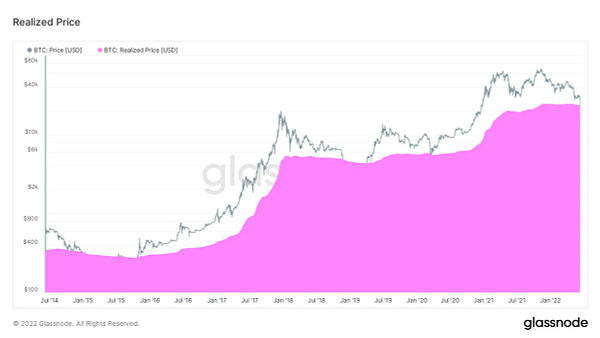

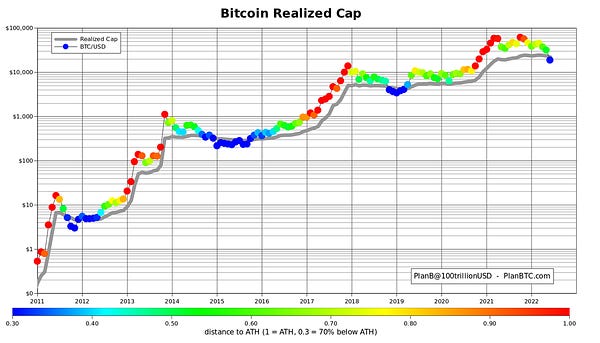

Lyn Alden: The average on-chain bitcoin holder is now below their cost basis. This is only the fifth time in bitcoin’s history that this has occurred.

BTC now sits near 2 standard deviation log regression channel:

Clemente accumulated BTC for the long-term bag here:

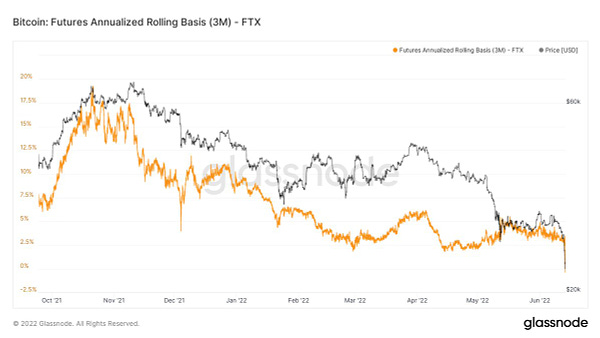

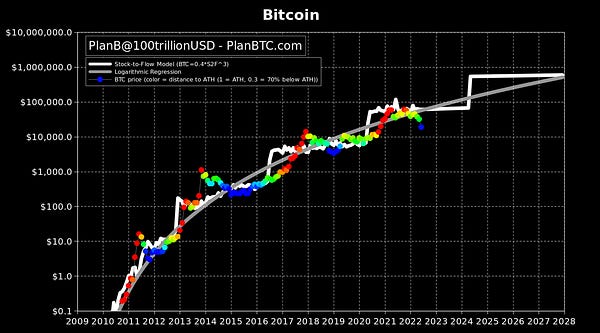

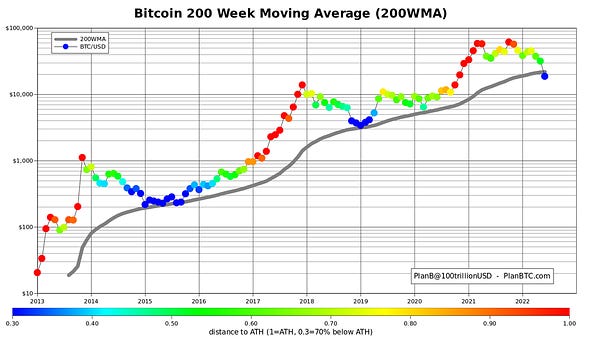

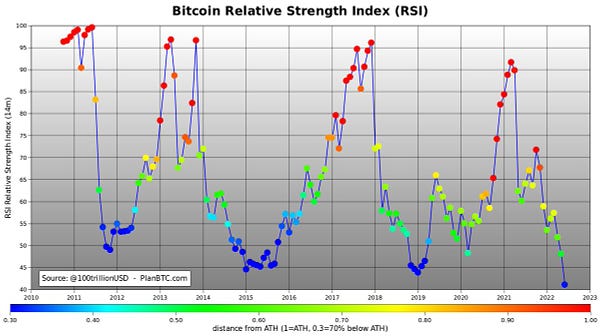

PlanB continues to inject hopium. His S2F is in the bin but admittedly, I do like the risk reward of playing mean reversion and buying oscillator extremes. Now is likely a better time to accumulate BTC than most other times.

3 ETH

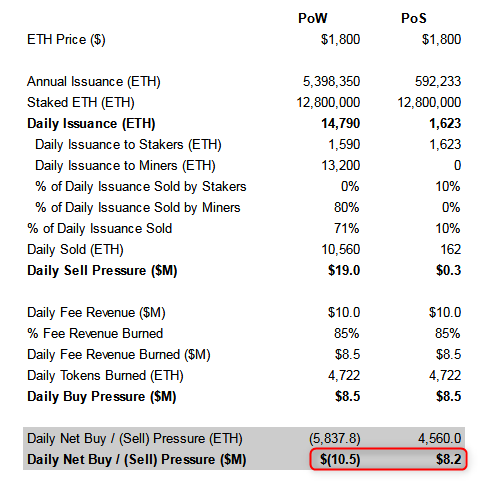

On the supply-demand dynamics of ETH post merge

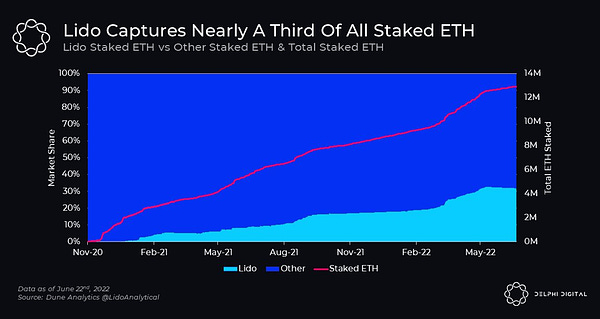

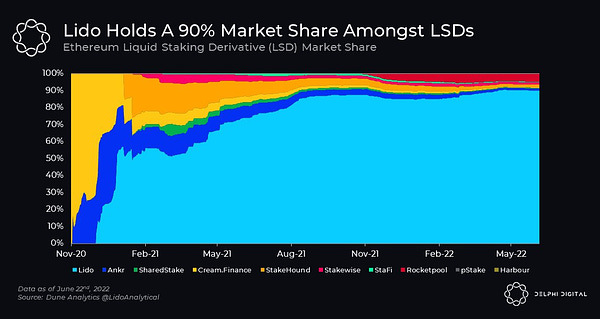

Lido dominance continues

Arbitrum launched its token incentive program, encouraging users to test out different product/service each week for a chance to earn airdrop. A week later, Odyssey was paused given gas price issues from capacity throttling. Now we have to wait until Nitro is launched. Not sure why they didn’t anticipate this to be an issue in the first place..

Bankless released a great explainer on how Layer 2 tokens accrue value. TLDR

rollups generate evenue from 2 sources: transaction fees and miner extractable value (MEV)

fees are paid to the sequencer, the entity responsible for ordering, batching and submitting transactions to L1

rollups profit by charging a premium (i.e. the spread between transactions fees paid by users and cost of purchasing L1 blockspace)

clearest use case of L2 token is by being used to decentralize the sequencer (i.e. requiring sequencers to stake a L2 token, with the likelihood of each staker being selected proportional to the size of its stake)

4 SOL

SOL is my largest L1 position outside of ETH, because in my experience, Solana ecosystem has always made a more concerted effort to onboard the next billion non-crypto native users. The bet also seconds as a hedge against the modular blockchain design, should the ETH roll-ups prove too complex to come to market in a reasonable time period.

Solana launched a phone and Solana Mobile Stack, to accelerate the adoption of Web3 by non-crypto native users and on mobile devices.

5 Defi

My investment research on Lifinity (LFNTY):

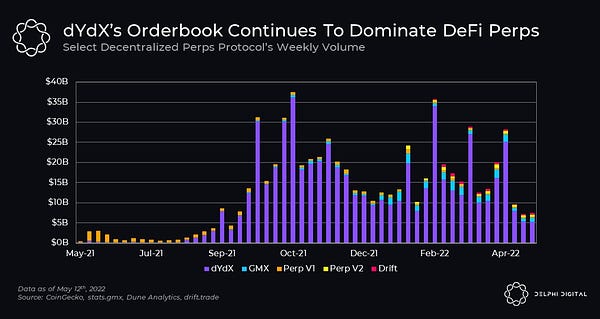

Decentralized perp volume grew 10x, but still only 2% of total volume.

6 Infrastructure

Investment thesis for GenesysGo (SHDW)

7 Other

As Jason says, a must read on crypto bridge risks and design:

Crypto needs to improve UI/UX and clarify its use cases before up only again:

On-chain analytics starter pack:

When someone comes out and declares funds are safu, funds are almost always not safu:

A simple mental model for knowing when bull market has resumed:

Portfolio allocation update

Target allocation update

Meta (gaming) allocation reduced to 2% from 7% to reflect significant drawdown in price performance of JEWEL and MC. I do not plan to add to those positions anytime soon.

New

No update

Existing

I deployed 14% of cash into BTC, ETH and SOL, with most of that capital going into ETH.

Cash remains at ~50% given the rest of my portfolio got rebalanced by the down only market.

Exits

No update

Contact me

Twitter: EtherKai @btc21m

Email: kai.btc21m@gmail.com

About Kai

Bought the 2017 top, fell down the crypto rabbit hole in 2020, full-time Magical Internet Money HODLer & user since.

Prior: a decade in TradFi (renewables/investment banking/capital markets).

Thank you

@cobie @Pentosh1 @CryptoHayes @zhusu @hasufl @Arthur_0x @FedGuy12 @KyleSamani @mrjasonchoi @woonomic @Rewkang @LynAldenContact @RaoulGMI @DegenSpartan @richwgalvin @finematics @santiagoroel @nic_carter @panicselling @EPBResearch @SBF_FTX @Delphi_Digital @biancoresearch

Disclaimer

This memo is presented for informational and entertainment purposes only and does not constitute financial advice. Individuals have unique circumstances, goals and risk tolerances, so please do your own research before making investment decisions.

Capitulation. Contagion. Worst on record.